Singlife Health Plus Review

The complete Pros and Cons on Singlife Health Plus

Singlife Health Plus is a rider for Singlife Shield, covering more of the co-insurance and deductibles payable by you in the event of hospitalisation.

Additional features are available such as lump-sum payouts for critical illness, kidney failure requiring dialysis, outpatient psychiatric cover and coverage for cancer treatments not on the Cancer Drug List.

Singlife Health Plus product details

We rated Singlife Shield and Singlife Health Plus as best for the entire family, refer to our 3 Best Integrated Shield Plans And Riders In Singapore (2023 Edition) for the detailed write-up.

- Non-participating policy – Integrated Shield Plan Rider

- 2 Rider Options

- Singlife Health Plus Private/Public Prime – covers up to all Deductibles, discounted child cover

- Singlife Health Plus Private/Public Lite – free child cover

- Singlife Shield Coinsurance Cover

- Pay only 5% of the medical bill after deductibles for treatments in the A&E or by Singlife’s preferred medical providers, up to $3,000 out-of-pocket

- Free or Discounted Child Cover

- Prime option – Discounted Singlife Shield coverage for up to 4 of your newborn child

- Lite option – Lite Singlife Shield coverage for up to 4 of your newborn child

- Singlife Shield Annual Deductible Coverage – For Singlife Health Plus Private/Public Lite

- Be covered 50% of Singlife Shield deductibles when you stay in a lower ward class than your plan allows

- Ambulance Fees or Hospital Transport

- Be covered $80 per injury or illness requiring an ambulance or other transport to the hospital

- Lump-sum Payout

- Get a lump-sum payout of $10,000 if diagnosed with critical illness, one claim only

- Get up to $3,000 for requiring kidney dialysis due to kidney failure, one claim only

- Mental Wellness Benefit

- Be covered up to $100 per visit for outpatient psychiatric consultations, up to $1,000 per policy year

- Cancer Treatments not under Cancer Drug List

- Be covered up to $30,000 per policy year for cancer treatments that are not under the Cander Drug List

Singlife Health Plus is a common search alternative for Singlife HealthPlus.

Read About: Integrated Shield Plan: How does it work?

Read About: Integrated Shield Plan: 4 things you should be aware of

Features of Singlife Health Plus at a glance

Based on the option with the highest coverage, Singlife Health Plus Private Prime

Inpatient hospital treatment

- Emergency overseas treatment: As charged, limited to costs of Singapore private hospitals

- Planned overseas treatment: As charged, limited to costs of Singapore private hospitals

- Pre-hospitalisation treatment: Up to 180 days

- Post-hospitalisation treatment: Up to 365 days for Private hospital and up to 365 days for Public hospital/Panel specialist

- Accident & Emergency Ambulance fee: S$80 per injury or illness

Outpatient hospital treatment

- Chemotherapy for cancer: As charged

- Immunotherapy for cancer: As charged

- Renal dialysis: As charged

- Psychiatric consultation: S$100/visit, up to S$1,000 per policy year

Unique Benefits

- Free Singlife Integrated Shield Plan coverage for up to 4 children when both parents are under Singlife – Lite option

- Planned Overseas treatment covered

- Moratorium underwriting option available for applicants with pre-existing conditions, subjected to Singlife approval

*IMPORTANT* Singlife Health Plus is an add-on to Singlife Shield (Integrated Shield Plan). The rider cannot be purchased without the basic Integrated Shield Plan.

Read About: No budget for financial planning?

Singlife Health Plus may be suitable if you are looking for

Singlife Health Plus may potentially be a good fit if the following matters to you:

- Hospitalisation and medical insurance coverage

- Integrated Shield Plan or Integrated Shield Plan riders

- Reducing hospitalisation and medical expenses

- Paying premium using MediSave Funds

- Daily hospitalisation income with an Integrated Shield Plan rider

Singlife Health Plus may not be suitable if you are looking for

Singlife Health Plus may potentially be a bad fit if the following matters to you:

- Surrender value, Integrated Shield Plan and/or Integrated Shield Plan riders have no cash value

What is the annual premium for Singlife Integrated Shield Plan and rider based on my age?

Refer to the table below for the premium table for Singlife Shield Plan 2 and Singlife Health Plus Public Lite.

| Age | Singlife Shield Plan 2 Actual Premium (Net premium payable after using MediSAVE) | Singlife Health Plus Public Lite with NCD (Premium for rider must be fully paid by cash) |

|---|---|---|

| 1 | S$86.8 (You pay S$0) | S$39.46 |

| 6 | S$86.8 (You pay S$0) | S$39.46 |

| 11 | S$86.8 (You pay S$0) | S$39.46 |

| 16 | S$86.8 (You pay S$0) | S$39.46 |

| 21 | S$99.92 (You pay S$0) | S$41.18 |

| 26 | S$99.92 (You pay S$0) | S$41.18 |

| 31 | S$169.57 (You pay S$0) | S$52.34 |

| 36 | S$169.57 (You pay S$0) | S$52.34 |

| 41 | S$314.92 (You pay S$0) | S$92.65 |

| 46 | S$343.18 (You pay S$0) | S$105.53 |

| 51 | S$472.37 (You pay S$0) | S$141.57 |

| 56 | S$498.61 (You pay S$0) | S$235.94 |

| 61 | S$780.22 (You pay S$180.22) | S$421.25 |

| 66 | S$1,230.39 (You pay S$630.39) | S$574.82 |

| 71 | S$1,822.88 (You pay S$922.88) | S$634.01 |

| New application or switching of Integrated Shield Plan/ rider is not allowed after age 75. | ||

| 76 | S$2,761.57 (You pay S$1,861.57) | S$660.63 |

| 81 | S$3,758.80 (You pay S$2,858.80) | S$688.07 |

| 86 | S$4,547.10 (You pay S$3,647.10) | S$707.81 |

| 91 | S$4,700.53 (You pay S$3,800.53) | S$822.77 |

| 96 | S$4,939.74 (You pay S$4,039.74) | S$1,140.21 |

Refer to our FAQs On Integrated Shield Plan And Riders for everything you need to know about upgrading your MediShield hospitalisation and medical treatment coverages.

Further considerations on Singlife Health Plus

- How much will Singlife or Singlife Health Plus premium increase as I age?

- How does Singlife Health Plus compare with Integrated Shield Plan and/ or Integrated Shield Plan riders from other insurance companies?

- Can Singlife Health Plus fulfill my financial insurance, health and protection needs?

The above information may not fully highlight all the product details and features on Singlife Health Plus. Talk to us or seek advice from a financial adviser before making any decision about Singlife Health Plus.

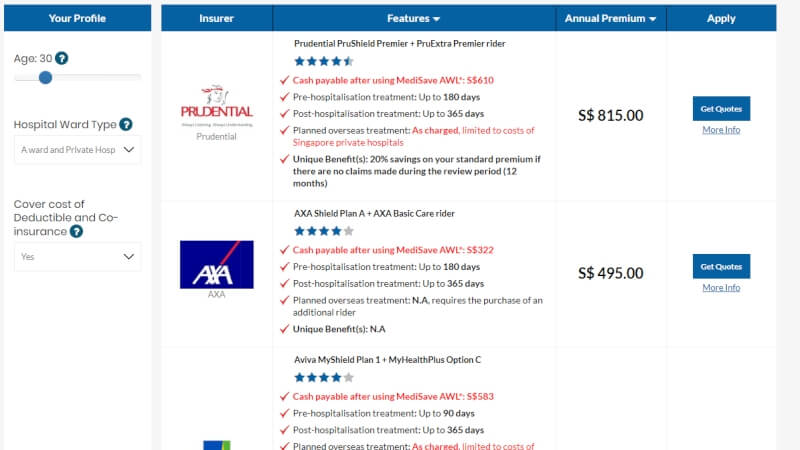

Compare across all Integrated Shield Plans and riders!

Compare before you commit so you don’t have to regret later on. Depending on your medical and hospitalisation needs, the premium payable differs across insurers. Why pay more for what you do not need or short-charge on features and benefits by paying a little more?

Get exactly what you need for your MediShield LIFE upgrade by using our Integrated Shield Plans and rider comparison platform. Go on, its 100% free!

Is Singlife Health Plus suitable for me?

Contact InterestGuru using the form below. Our panel of licensed financial advisers will advise accordingly, based on your financial profile and protection needs.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore