NTUC Income Gro Retire Flex Review

The complete Pros and Cons on NTUC Income Gro Retire Flex

NTUC Income Gro Retire Flex product details

- Life policy – Annuity

- Flexible Premium Terms

- Choose a lump-sum single premium or regular premium payment term of 5, 10, 15, 20, 25 or 30 years

- For single premium option, you can pay with cash or your SRS

- Retirement Income Payouts

- Receive monthly guaranteed income & non-guaranteed bonuses

- Choose to receive these payouts over 10 or 20 years or up till age 100

- Spend these payouts as you wish or accumulate them at up to 3.25% per annum

- Secondary Life Assured

- You can choose to assign a secondary life assured to carry on enjoying the benefits of this policy should you pass on before policy reaches its maturity

- Insurance Coverage; be covered against Death & Terminal Illness

- During the accumulation period – 105% of net premiums paid and 100% of terminal bonus (if any)

- During the payout period – 105% of net premiums paid and 100% of terminal bonus, less any payouts paid

- Retrenchment Benefit

- Premiums will be waived for 6 months should you become retrenched for 3 consecutive months

- Accidental Death Benefit

- Receive additional 105% of all net premiums paid should accidental death occur before age 70

- Disability Care Benefit; loss of use one one limb, speech, sight of one eye or hearing

- During accumulation period – future premiums waived and lump sum benefit (6x the guaranteed monthly income)

- During payout period – receive additional 50% of the guaranteed monthly income during the payout period

Read about: The 4 best Retirement Annuity plans in Singapore (2023 Editions)

Read about: The Complete Guide to Retirement Planning (2023 Edition) *NEW*

Features of NTUC Income Gro Retire Flex at a glance

Cash and Cash Withdrawal Benefits

Cash value: Yes

Cash withdrawal benefits: Yes

Health and Insurance Coverage

Death: Yes

Total Permanent Disability: Yes

Terminal Illness: Yes

Critical Illness: No

Early Critical Illness: No

Health and Insurance Coverage Multiplier

Death: No

Total Permanent Disability: No

Terminal Illness: No

Critical Illness: No

Early Critical Illness: No

Optional Add-on Riders

Cancer Premium Waiver (GIO)

Dread Disease Premium Waiver

Additional Features and Benefits

Yes.

For further information and details, refer to NTUC Income website. Alternatively, fill-up the form below and let us advise accordingly.

Read about: 3 things to consider before taking up a new financial product

Read about: Effects of compounding returns on your investments

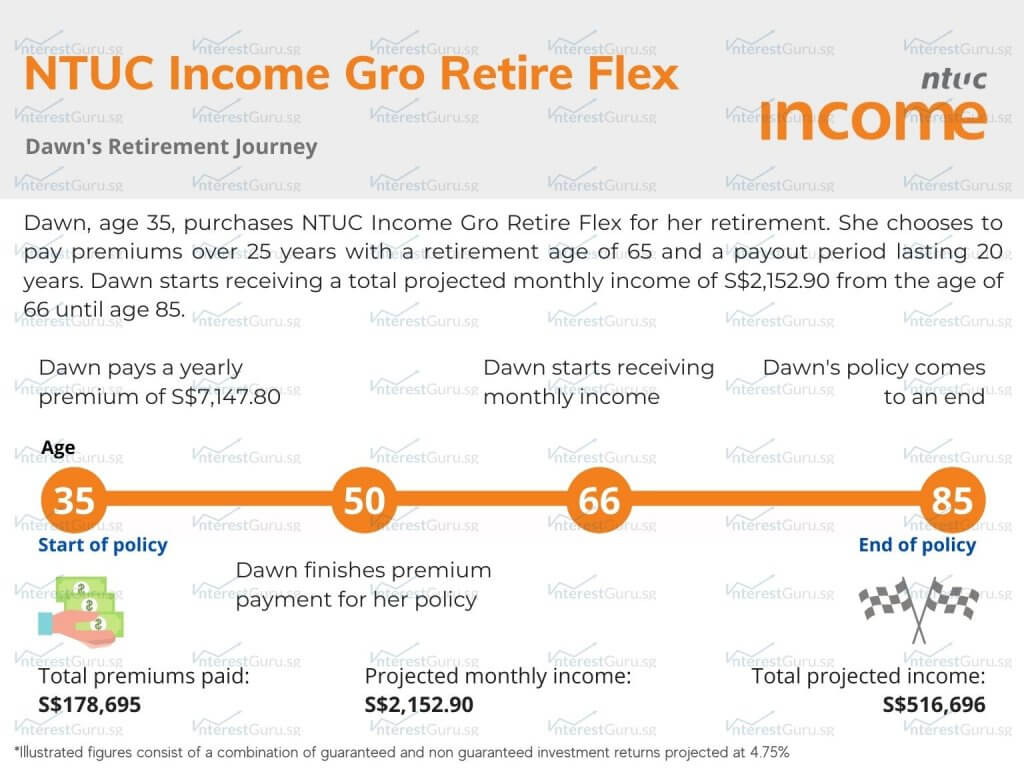

Policy Illustration for NTUC Income Gro Retire Flex, Dawn

Dawn, age 35, purchases NTUC Income Gro Retire Flex for her retirement. She pays a yearly premium of S$7,147.80 for the next 25 years and a retirement age of 65 with a payout period of 20 years, ensuring she receives stable income until ag 85.

By age 50, Dawn finishes paying her premium payments for her NTUC Income Gro Retire Flex policy with S$178,695 paid in premiums.

Upon the age of 66, Dawn starts receiving a projected total monthly income of S$2,152.90. The total projected monthly income consists of guaranteed income and non-guaranteed bonuses.

If and Dawn loses the ability to perform 2 of 6 Activities of Daily Living (ADLs), she will receive an additional S$1,000 per month.

By age 85, Dawn would have received a total projected income of S$516,696. Her NTUC Income Gro Retire Flex policy terminates thereafter.

Policy Illustration for NTUC Income Gro Retire Flex, Jane

Jane, age 35, purchases NTUC Income Gro Retire Flex for her retirement. She pays a yearly premium of S$16,067.80 and a retirement age of 65with a payout period of 20 years, ensuring she receives stable income until age 85.

By age 35, Jane finishes paying his premium payments for his NTUC Income Gro Retire Flex policy with S$107,834 paid in premiums.

Upon reaching the age of 66, Jane starts receiving a projected total monthly income of S$2,732.80. The total projected monthly income consists of guaranteed income and non-guaranteed bonuses.

If and Jane loses the ability to perform 2 of 6 Activities of Daily Living (ADLs), she will receive an additional S$1,000 per month.

By age 85, Jane would have received a total projected income of S$655,872. Her NTUC Income Gro Retire Flex policy terminates thereafter.

NTUC Income Gro Retire Flex may be suitable if you are looking for

NTUC Income Gro Retire Flex may potentially be a good fit if the following matters to you:

- Regular cash payout during your retirement

- Saving regularly over a period of time

- Pay a single premium with no further financial commitment

- SRS payment option retirement annuity

- Insurance options without medical underwriting

- Do not need access to the funds until retirement

- To potentially generate higher financial returns compared to bank accounts

NTUC Income Gro Retire Flex may not suitable if you are looking for

NTUC Income Gro Retire Flex may potentially be a bad fit if the following matters to you:

- Health and Protection coverage

- High insurance coverage for Death or Terminal Illness

- Insurance coverage for Early Critical Illness, Critical Illness or Total Permanent Disability

- Lump-sum payout upon maturity

- A one-time premium commitment with no further cash commitment

- Potentially higher financial returns compared to a pure investment product.

- Insurance policy with a high surrender value in the early years of the policy.

Further considerations on NTUC Income Gro Retire Flex

- How is NTUC Income or NTUC Income Gro Retire Flex investment returns based on historical performance?

- How does NTUC Income Gro Retire Flex compare with Endowment policy from other insurance companies?

- Can NTUC Income Gro Retire Flex fulfill my financial, insurance, health, and protection needs?

The above information may not fully highlight all the product details and features on NTUC Income Gro Retire Flex. Talk to us or seek advice from a financial adviser before making any decision about NTUC Income Gro Retire Flex.

Always ensure your long-term financial goals and objectives are aligned with the financial product you are considering to take up.

Where can I compare the payout and benefits of retirement plans and annuity policies?

Your retirement plans are meant to supplement your lifestyle and expenses in your golden years. Ensure your retirement plans matches the financial goal and objective you wish to achieve when you decided to talk a step back in life.

It is too late to regret once you have made your financial commitment. Specific product features, benefits, and payouts will differ more than you think across insurance companies.

And even worse, to know you can compare retirement plans and annuity policies here, 100% free of charges on the InterestGuru.sg platform.

Is NTUC Income Gro Retire Flex suitable for me?

Contact InterestGuru using the form below. Our panel of licensed financial advisers will advise accordingly, based on your financial profile and protection needs.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Get your perfect retirement plan!

3 easy steps for your customised retirement income plan based on your financial needs.

Step 1: Getting to know you…

Let's start with your personal profile. Please note that your current age and gender will affect the insurance premium payable for your retirement plan.

Name:

Gender:

Birthdate:

Step 2: Understanding your retirement needs…

Please select your desired retirement income and the payout age for your retirement plan from the selections below:

What is your ideal monthly retirement income?

What is your ideal retirement age?

Step 3: Finding the best retirement plans for you!

Interestguru.sg team of financial planners will compare and provide you with the best retirement plans based on your inputs.

Contact:

Email:

Please check your inbox for an e-mail of your savings needs.

We will be in contact with you within 24 hours.