[In-Depth Comparison] 3 Best SRS Retirement Plans for Wealth Accumulation in Singapore

InterestGuru.sg in-depth analysis on the 3 best Supplementary Retirement Scheme (SRS) approved retirement annuity plans.

- The Supplementary Retirement Scheme (SRS) allows individuals to save for retirement, over and above their CPF savings.

- SRS monies can be invested in SRS-approved financial instruments like ETFs, annuities and insurance, unit trusts and shares.

- SRS-approved Retirement Annuity plans allow you to generate stable long-term financial returns.

The best SRS-approved retirement annuity plans for wealth accumulation

For the purpose of this review, we are focused on reviewing the best SRS-approved retirement annuity plans. The retirements plans featured here offers stable financial returns and guaranteed of principal upon maturity.

- Best SRS Retirement Plan for Additional Disability Income – Manulife RetireReady Plus

- Best SRS Retirement Plan for Inflation-proofed Income (Lifetime) – AXA Retire Happy Plus

- Best SRS Retirement Plan for Highest Income Payout – Aviva MyIncomePlus

The stated SRS retirement plans are not presented in any order of preferences due to individual policies advantages and shortfalls.

How can you get higher financial returns on your SRS account?

The interest rate in your SRS account has generally been low at 0.05% p.a. However, it is possible to use your SRS funds for a wide range of SRS-approved financial instruments.

In general, you can invest your SRS monies based on your investment risk appetite:

Lower Risk and Stable Long-term Returns

Higher Risk and Higher Potential Returns

Related article: 5 ways to use your CPF funds (other than housing and retirement)

Best SRS retirement plan for additional disability income – Manulife RetireReady Plus

Manulife RetireReady Plus will be 100% principal guaranteed upon retirement age and comes with Loss of Independence Benefits. This bundled rider pays out an additional stream of income in the event of disability.

Loss of Independence Benefits (Payable on top of your monthly income)

- Failing 2 of 6 Activities of Daily Living (ADLs) – 50% of monthly guaranteed income

- Failing 3 of 6 Activities of Daily Living (ADLs) – 100% of monthly guaranteed income

You can choose the income payout from RetireReady Plus to last for 5, 10, 15, 20 years or for a lifetime. To cater to your changing financial needs, you can adjust the income payout period, up to 2 years before the start of the payout.

- Shorter income payout period – Higher monthly income

- Longer income payout period – Lower monthly income

What makes Manulife RetireReady Plus an outstanding SRS retirement plan?

Among all the SRS-approved retirement plans, we highlighted Manulife RetireReady Plus for the following product features and benefits:

- Additional guaranteed monthly income in the event of disability

- Flexibility to change your income payout period after taking up the plan

Refer to: Manulife RetireReady Plus (The complete policy review)

Manulife RetireReady Plus is also featured in the 3 Best Retirement Annuity Plans in Singapore – Income Payout and Product Features

Best SRS retirement plan for inflation-proofed income (Lifetime) – AXA Retire Happy Plus

AXA Retire Happy Plus is a highly flexible savings plan with various premium term and income payout options designed to supplement your retirement funds. As with any other income payout policies, it can also be used to support other specific savings goals you have along the way.

Upon diagnosis of Total and Permanent Disability (TPD), there will be an additional lump sum benefit payable to help finance daily living expenses while the plan stays in-force.

What makes AXA Retire Happy Plus an outstanding SRS retirement plan?

Among all the SRS-approved retirement plans, we highlighted AXA Retire Happy Plus for the following product features and benefits:

- Options to have an increasing/ inflation-proofed income payout

- One time payout of 5x of yearly guaranteed income if TPD occurs before retirement starts

Refer to: AXA Retire Happy Plus (The complete policy review)

AXA Retire Happy Plus is also featured in the 3 Best Retirement Annuity Plans in Singapore with an Inflation-proofed Payout

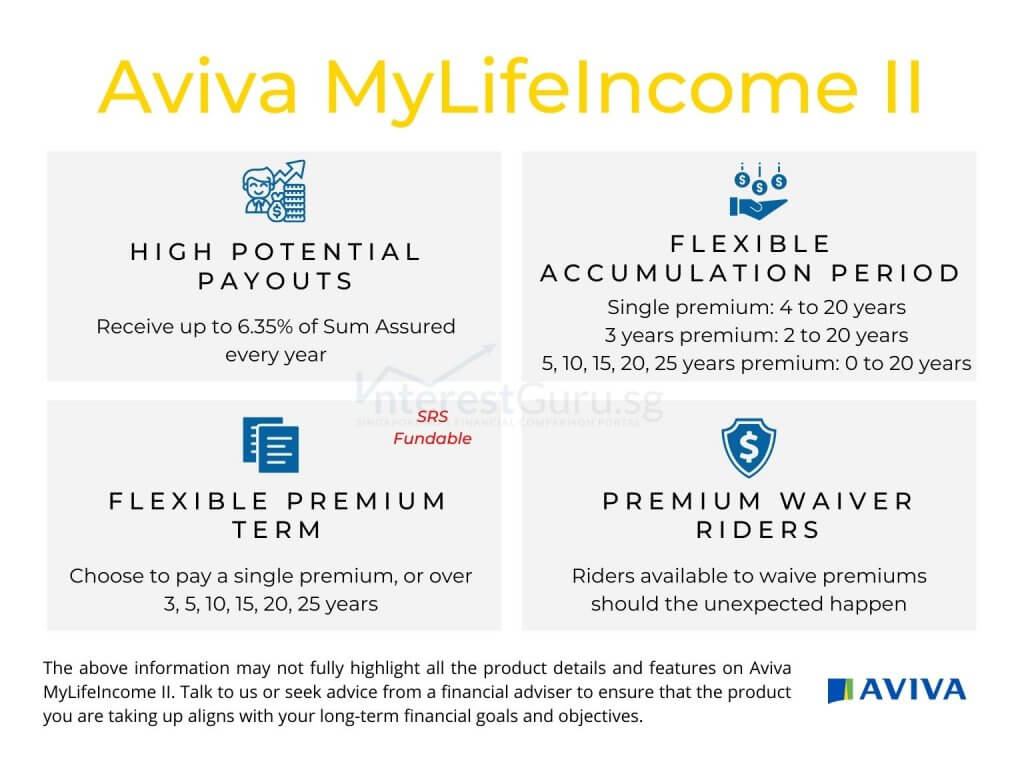

Best SRS retirement plan for highest income payout – Aviva MyIncomePlus

Unlike the above 2 retirement plans, Aviva MyIncomePlus offers a very limited income payout options of either only 10 or 15 years. However, the lack of payout options allows for Aviva to provide the highest rate of financial payout on an SRS retirement annuity plan.

MyIncomePlus will work in your favor if you are looking for the highest rate of return, with a short income payout period. While it may not be suitable for everyone, it certainly does its job of providing a high and stable rate of financial returns on for your SRS monies.

What makes Aviva MyIncomePlus an outstanding SRS retirement plan?

Among all the SRS-approved retirement plans, we highlighted Aviva MyIncomePlus for the following product features and benefits:

- Highest guaranteed income payout over a 10 or 15 year period

- Highest projected income payout over a 10 or 15 year period

Refer to: Aviva MyIncomePlus (The complete policy review)

Which SRS retirement annuity plan should you choose?

Depending on your overall financial portfolio, each of the retirement annuity plan reviewed here can be used to fulfil shortfalls in your retirement income in different ways.

Highest Rate of Financial Returns

Aviva MyIncomePlus is best for having a no-frill highest rate of income payout over fixed 10 or 15 years retirement payout period. Both the guaranteed and projected financial returns far surpass other SRS- approved retirement plans.

However, with a maximum income payout period of only 15 years, you may run into longevity risk, and there are no other sources of income for your later years.

Additional Income for Disability

Be it via Cash or SRS, Manulife RetireReady Plus will the best retirement plan if you are concerned with long-term care expenses in the event of disability.

Get up to 2x of your guaranteed monthly income if you fail to perform at least 3 of 6 ADLs. Alternatively, RetireReady Plus also pays an additional 50% of your guaranteed monthly income if you fail to perform a minimum of 2 of 6 ADLs.

Lifetime Guaranteed Increasing Payout

Among the SRS-approved retirement plans, AXA Retire Happy Plus offers the most competitive options if you need a lifetime payout that is inflation-proofed as well.

However, for the same insurance premium, your initial yearly income payout will be significantly lower compared to MyIncomePlus or RetireReady Plus. The lower initial payout is compensated by Retire Happy Plus offering a lifelong payout that is guaranteed to increase on a yearly basis.

Related article: The comprehensive guide to retirement planning in Singapore (2023 Edition) *NEW*

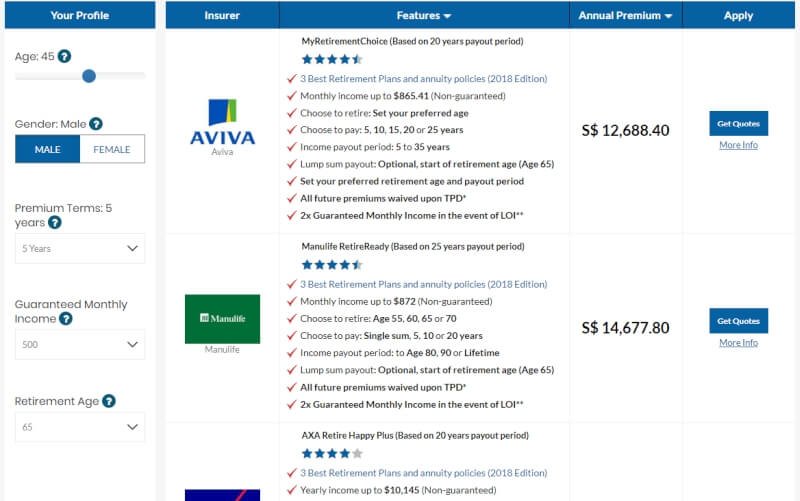

Where can I compare the payout and benefits of retirement annuity policies?

It is too late to regret once you have made your financial commitment. Specific products features, benefits and payout will differ more than you think across insurance companies.

And even worse, to know you can compare retirement plans and annuity policies here, 100% free of charges on the InterestGuru.sg platform.

Find out about the best retirement annuity policies!

Our partnered financial planners will draft their proposals based on your given input and your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

*For a limited time, get attractive incentives when you take up any products that is proposed by our team of financial planners.

Compare retirement annuities quotations from all leading insurers in Singapore

Getting the best retirement plans has never been this easy!

Drop us a message to have a retirement plan structured to your needs or just to understand more. Don’t worry, there is no obligation to take up any recommended products or services!

Note: All financial figures are based on close approximate and all non-guaranteed figures are based on the higher tier of 4.75% investment returns. The sample illustrations are for illustrative purposes only and is not a contract of insurance. Early surrendering or cashing out from a Retirement plans or Annuity policies will certainly result in financial loss. In the event of doubt, always refer to the precise terms and conditions as specified in your policy contract. Seek the advice of a qualified financial professional or a licensed financial adviser before making any decision or financial commitment.

*Terms and conditions may apply, speak to our financial planners or drop us a message for more details.