The 7 Best Regular Insurance Savings Plans in Singapore (2023 Edition)

Learn more about the outstanding insurance savings plans with the best financial returns when you choose to save regularly.

Compared to banking accounts, insurance savings plans can provide high and stable financial returns in return for your commitment to saving regularly. While savings plans are offered by all insurance companies in Singapore, their individual product benefits and financial returns may vary due to a wide range of factors.

As a long-term financial commitment is required, it is certainly in your best interest to ensure that you are getting the best value for your money.

Look no further, as we reveal the best insurance savings plans in Singapore to suit all your individual savings preferences!

The Best Insurance Savings Plans in Singapore for Wealth Accumulation

In this comprehensive review, we look into 7 Insurance Savings Plans that allow you to receive the highest financial gains for your regular savings.

- Best Insurance Savings Plan for Guaranteed Returns: Aviva MySaving Plan / Aviva MyWealthPlan

- Best Insurance Savings Plan for Lifetime Financial Returns: Manulife ReadyBuilder

- Best Insurance Savings Plan for Lifetime Projected Returns: Prudential PruWealth

- Best Insurance Savings Plan for Partial Withdrawal Benefits: Manulife ReadyPayout Plus

- Best Insurance Savings Plan for Lifetime Cashback Benefits: Aviva MyLifeIncome

- Best Insurance Savings Plan for Shortest Premium Term (3yrs): NTUC Income Gro Goal Saver

- Best Insurance Savings Plan for Investment Returns: AXA Pulsar

To get the most out of your insurance savings plans, ensure that it is properly customised to meet your individual financial needs and objectives.

Note: This list of the 7 Best Insurance Savings Plans in Singapore is last updated on 10/05/2023.

How do we come up with this list of the 7 Best Insurance Savings Plans in Singapore?

The following criteria were considered in our review for the 7 Best Insurance Savings Plans in Singapore (2023 edition):

- Competitiveness of insurance premium against financial returns

- The rate of returns against the required commitment/ lock-in period

- Product features that enhance financial returns to the policyholder

Note: This review of the 7 Best Insurance Savings Plans in Singapore is not ranked in any order of priorities or preferences.

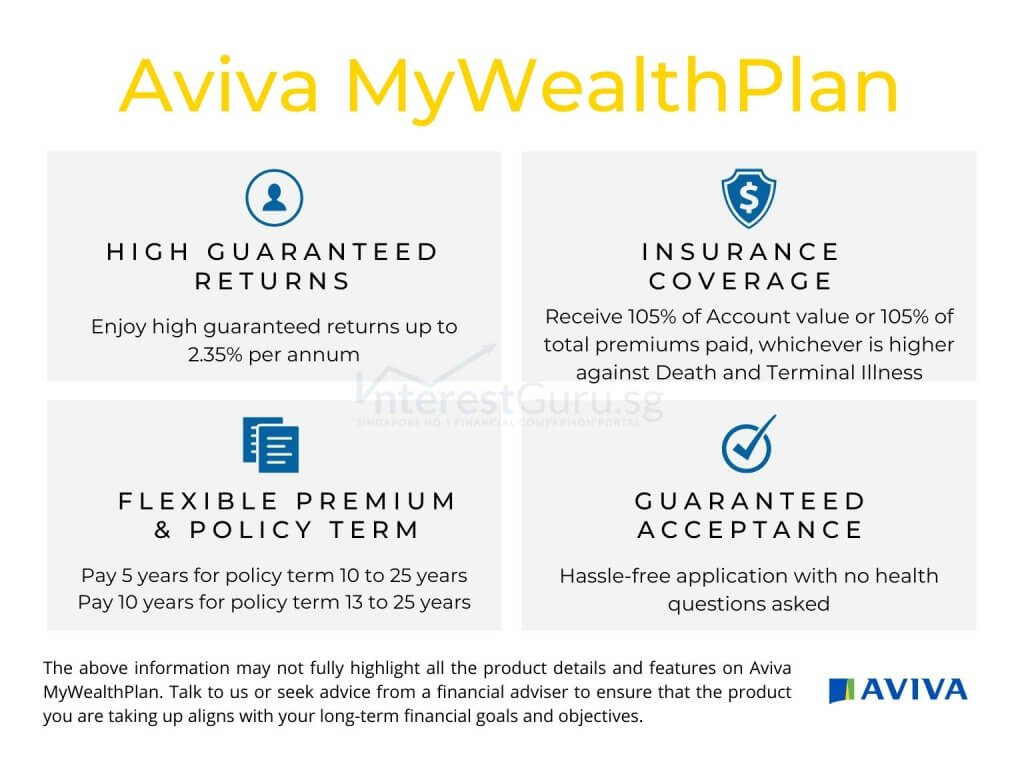

Best Insurance Savings Plan for Guaranteed Returns: Aviva MySavingPlan/ Aviva MyWealth Plan

For the highest guaranteed maturity value, Aviva MyWealthPlan and Aviva MySavingsPlan will be the ideal savings insurance plans for you. Upon maturity, you can expect to receive one of the high guaranteed financial value across all the insurers in Singapore.

Both mentioned insurance savings plans have a fixed maturity, making them suitable for reaching a single future financial goal or objective.

Key differences for Aviva MyWealthPlan and Aviva MySavingsPlan

- Aviva MyWealthPlan is a limited premium term policy – Save for a short period of 5 or 10 years and choose your maturity up to the 25th policy year.

- Aviva MySavingsPlan is a regular premium term policy – Save regularly throughout the period of 10 to 25 years with maturity at the end of your saving period.

Case study for Aviva MyWealthPlan (Limited premium term)

Assuming Michelle, age 30 starts Aviva MyWealthPlan with the following savings budget and objectives:

- Regular savings amount: $500 monthly

- Regular savings commitment: 10 years

Her total premium paid will be $60,000 and she can choose to have the plan maturity on the 20th or 25th policy year from now.

Sample financial Illustration for Aviva MyWealthPlan

Michelle projected maturity value for Aviva MyWealthPlan at the end of the 20th or 25th years from now:

- With maturity at the end of the 20th year from now:

- Guaranteed surrender value: $74,000

- Projected surrender value: $105,000

- With maturity at the end of the 25th year from now:

- Guaranteed surrender value: $86,000

- Projected surrender value: $132,000

Refer to: Aviva MyWealthPlan review

Case study for Aviva MySavingsPlan (Regular premium term)

Assuming Michelle, age 30 starts Aviva MySavingsPlan with the following savings budget and objectives:

- Regular savings amount: $500 monthly

- Regular savings commitment: 25 years

Her total premium paid will be $150,000 and her savings plan will mature on the 25th policy year from now.

Sample financial Illustration for Aviva MySavingsPlan

Michelle projected maturity value for Aviva MySavingsPlan at the end of the 25th years from now:

- Guaranteed surrender value: $170,600

- Projected surrender value: $251,000

Refer to: Aviva MySavingsPlan review

Best Insurance Savings Plan for Lifetime Savings: Manulife ReadyBuilder

With Manulife ReadyBuilder, you can plan for multiple savings goals and objectives within a single insurance savings plan. Not only are you assured of a stable and high rate of returns on your savings, but you can also make unlimited withdrawals from the cash value of the policy.

When all your savings goals are met, the remaining cash value left in your ReadyBuilder can be re-assigned to your close ones to build up their finances.

Case study for Manulife ReadyBuilder

Assuming Jane, age 25 starts Manulife ReadyBuilder with the following savings budget and objectives:

- Regular savings amount: $6000 yearly

- Regular savings commitment: 20 years

The total premium paid over the 20 years period works out to be $120,000.

Sample financial Illustrations for Manulife ReadyBuilder

Assuming Jane has not done any withdrawal and wish to completely surrender the Manulife ReadyBuilder for its cash value.

She can expect to receive a lump sum cash value based on the following:

- Projected surrender value at age 65: $398,041

- Projected surrender value at age 75: $576,760

Assuming Jane, at age 40, has made no withdrawal on the policy and choose to re-assign it to her new-born child (Joe).

If Joe chooses not to make any withdrawal, he can expect a lump sum cash value based on the following:

- Projected surrender value at age 45: $836,149

- Projected surrender value at age 60: $1,416,254

Refer to: Manulife ReadyBuilder review

Best Insurance Savings Plan for Lifetime Projected Returns: Prudential PruWealth

In term of wealth accumulation features, Prudential PruWealth is similar to Manulife ReadyBuilder with one exception. You can only start to make a partial withdrawal from the cash value of the policy after the 20th policy year.

However, the projected or non-guaranteed cash value PruWealth is notable over a long time horizon with the option to save and generate returns in SGD or USD currency.

Case study for Prudential PruWealth

Assuming Jane, age 25 starts Prudential PruWealth with the following savings budget and objectives:

- Regular savings amount: $530 monthly

- Regular savings commitment: 10 years

The total premium paid over the 10 years period works out to be $63,600.

Sample financial Illustrations for Prudential PruWealth

Assuming Jane has not done any withdrawal and wish to completely surrender the Prudential PruWealth for its cash value.

She can expect to receive a lump sum cash value based on the following:

- Projected surrender value at age 60: $159,427

- Projected surrender value at age 70: $242,707

Refer to: Prudential PruWealth review

Best Insurance Savings Plan for Partial Withdrawal Benefits: Manulife ReadyPayout Plus

Manulife ReadyPayout Plus allows you to receive cash payouts, via yearly increasing partial withdrawals from your policy cash value. You get to enjoy maximum flexibility on your savings, with withdrawal available from the end of your first policy year.

With your future premiums waived upon total permanent disability, your financial goals can stay on track even if an unforeseen life event occurs.

Case study for Manulife ReadyPayout Plus

Assuming Jane, age 45 starts Manulife ReadyPayout Plus with the following savings budget and objectives:

Jane is looking to save for her retirement at age 65, yet does not wish to have all her funds lock up within an insurance savings plan. Manulife ReadyPayout Plus was chosen due to the high cashback/ partial withdrawal benefits, especially in the later years of the policy.

- Regular savings amount: $1,000 monthly

- Regular savings commitment: 15 years

The total premium paid over the 15 years period works out to be $180,000.

Sample financial Illustrations for Manulife ReadyPayout Plus

She can expect to receive a lump sum cash value based on the following:

- Projected surrender value at age 65: $266,720

At the cost of a lower surrender value, Jane will be able to withdraw from her savings insurance plan with withdrawal amount increasing over the years:

- Yearly during the 1st to 5th year – $2392

- Yearly during the 6th to 10th year – $4,784

- Yearly during the 11th to 15th year – $7,176

- Yearly during the 16th to 19th year – $11,960

The total amount of partial withdrawal she can make from Manulife ReadPayout Plus work out to be $119,600 over the course of the policy.

Refer to: Manulife ReadyPayout Plus review

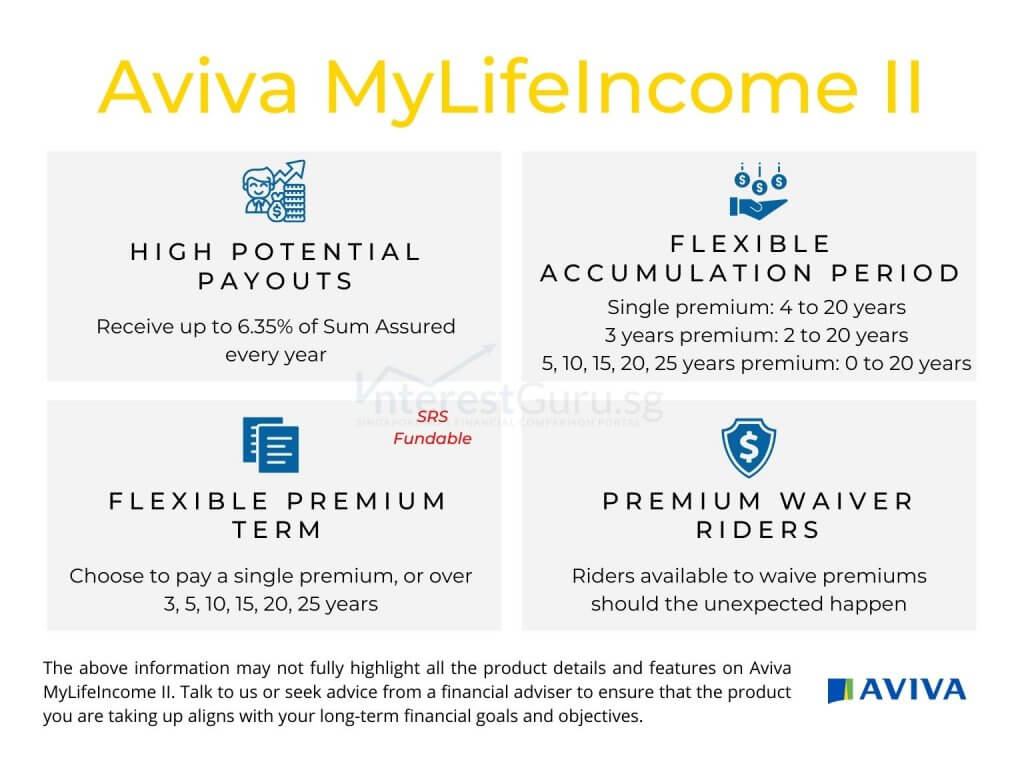

Best Insurance Savings Plan for Yearly Cashback Benefits: Aviva MyLifeIncome

Aviva MyLifeIncome is a flexible insurance savings plan that allows you to receive a lifetime of yearly cashback or income payout starting from the 5th policy year. Have the flexibility of using your yearly cashback for all your lifestyle goals be it regular overseas trips, monthly dining expenses or even as a retirement income.

With 100% principle guaranteed features, choose to stop receiving a yearly income anytime to collect a single lump sum payout instead. Alternatively, accumulate your yearly cashback to generate higher financial returns until you really need to withdraw your savings.

Case study for Aviva MyLifeIncome

Assuming Michelle, age 40 starts Aviva MyLifeIncome with the following savings budget and objectives:

- Regular savings amount: $25,000 yearly

- Regular savings commitment: 10 years

The total premium that Jane has paid for the policy will be $250,000 and she intends to receive a yearly cashback starting from age 60 onwards.

Sample financial Illustrations for Aviva MyLifeIncome

By age 55, the surrender value for the Aviva MyLifeIncome is guaranteed to be higher than the total premium that she has paid for the policy.

- Projected lifetime yearly income starting from age 60: $22,900

Anytime after collecting her yearly income, Michelle can surrender her MyLifeIncome for a guaranteed cash value that is higher than the total premium that she has paid.

Refer to: Aviva MyLifeIncome review

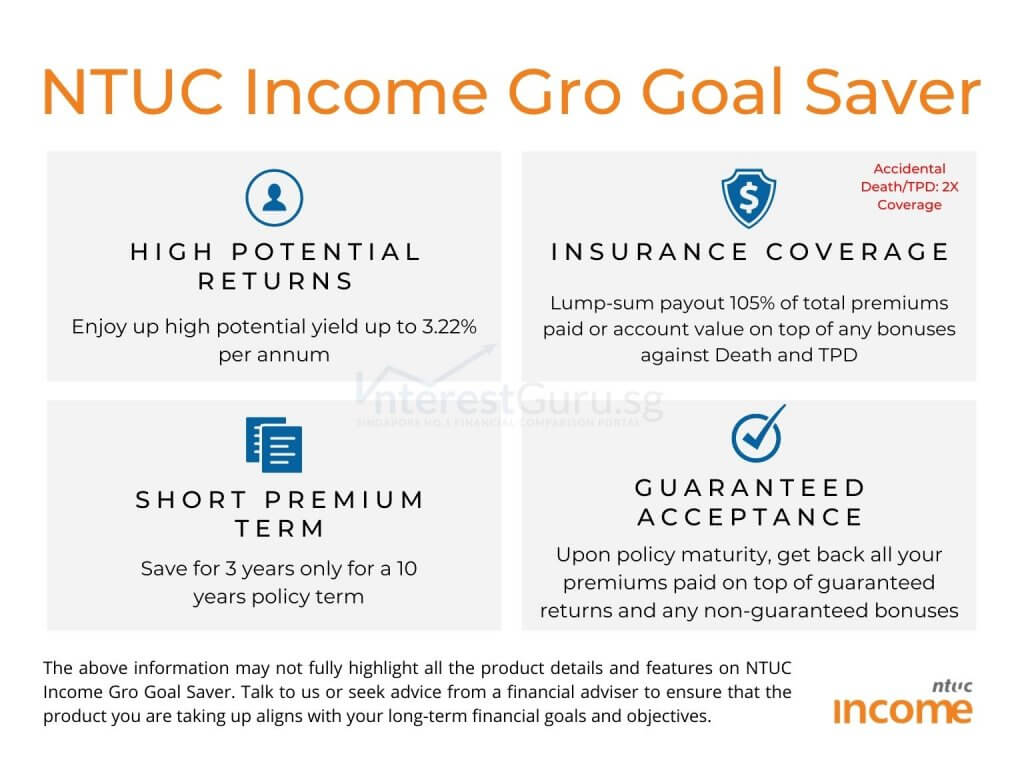

Best Insurance Savings Plan for Shortest Premium Term (3 yrs): NTUC Income RevoEase

NTUC Income RevoEase is a limited premium term insurance savings plan where you only need to pay premiums for the first 3 years of the policy. With a fixed maturity on the 10th policy year, RevoEase provides a boost to your savings for your short to mid-term financial goals.

In addition, be assured with 100% guaranteed principal upon the maturity on the 10th year of the policy.

Case study for NTUC Income Gro Goal Saver

Assuming Joe, age 50 starts NTUC Income Gro Goal Saver with the following savings budget and objectives:

- Regular savings amount: $20,000 yearly

- Regular savings/ investment commitment: 3 years

Sample financial Illustrations for NTUC Income Gro Goal Saver

Joe projected maturity value for NTUC Income Gro Goal Saver at the end of the 10 years from now:

- Guaranteed surrender value: $62,964

- Projected surrender value: $79,708

Refer to: NTUC Income Gro Goal Saver review

Best Insurance Savings Plan for Investment Returns: AXA Pulsar

AXA Pulsar works as an investment-linked policy with minimal insurance coverage. This allows the policy to be structured as a long-term investment portfolio for the purpose of generating high investment returns on your savings.

Due to the nature of the plan, AXA Pulsar has no guaranteed cash value as the value of the policy fluctuates daily accordingly to market valuations.

Case study for AXA Pulsar

Assuming Alvin, age 20 starts Aviva MyLifeIncome with the following savings budget and objectives:

- Regular savings amount: $300 monthly

- Regular savings/ investment commitment: 30 years

The total premium that Alvin has paid for the policy will be $108,000 and he can make withdrawals in multiples of $1,000 from the cash value of the policy.

Sample financial Illustrations for AXA Pulsar

- Projected surrender value at age 55: $305,600

- Projected surrender value at age 60: $389,700

- Projected surrender value at age 65: $497,000

Note: As AXA Pulsar is an investment-linked policy, the projected surrender value are close approximates based on an illustrated 8% investment returns with no withdrawal made from the cash value of the policy.

Refer to: AXA Pulsar review

What other options should you consider besides an insurance savings plan?

Insurance savings plans, also known as endowment savings plans are commonly recommended by your financial adviser for getting higher interest on your savings. Depending on your age, budget and investment risk appetite, there may be better wealth accumulation options.

You may also wish to consider the following life insurance policies with both coverage and wealth accumulation features:

- Whole Life Plans – Lifelong coverage with stable wealth accumulation

- Investment Linked Policies – Coverage with potentially high investment returns

Read about: 3 things to consider before taking up a new financial product

Read about: 8 commonly made financial mistakes by Singaporeans

An alternative to insurance savings plans: Whole Life Plans

In your 20s or early 30s, the total premium paid over a limited period in a whole life insurance plan may end generating higher financial returns compared to an insurance savings plan.

Not only do you get insurance coverage, but the accumulated cash value is also guaranteed to increase over time. The cash value can then be withdrawn at later stages of your life for other financial goals, such as a lump sum payout or a monthly income stream.

Read about: 3 Best Whole Life Plans for Coverage and Wealth Accumulation (2023 Edition)

Read about: 8 Best Whole Life Plans in Singapore based on Product Features (2023 Edition)

An alternative to insurance savings plans: Investment Linked Policies

Investment linked policies (ILPs) combines elements of insurance and investment to provide coverage and projected investment returns. An attractive feature of ILPs is that cash can be withdrawn from the available cash value within the policy.

Unlike a whole life plan, the cash value in ILPs is based on projections of investment returns. These projected financial cash values may have high fluctuations and such policies may not be suitable if you are reluctant to take on any form of risk.

Read about: 3 Best Investment Linked Policies in Singapore for Coverage and Wealth Accumulation (2023 Edition)

Which insurance savings plans are the most suitable for you?

Contact InterestGuru using the form below and a licensed financial adviser will advise you accordingly, based on your financial profile and protection needs.

All proposals provided are 100% free of charge with no obligation to take up any proposed financial products or services in any way.

*For a limited time, get attractive incentives when you take up any product that is proposed by our team of financial planners.

We compare insurance savings plans from all leading insurers in Singapore!

Maximise your wealth with the best savings plans!

3 easy steps for your customised insurance savings plan

Step 1: Getting to know you…

Let’s start with a brief introduction of your personal profile. This will allow us to adjust and provide the most relevant insurance savings plans for you.

Name:

Gender:

Birthdate:

Step 2: Understanding your savings needs…

Please select your savings preferences to allow us to optimise the financial returns of your savings plans:

You have a yearly savings budget (annual premium) of:

You intend to have a saving commitment for a period (premium term) of:

Step 3: Finding the best insurance savings plans for you!

Interestguru.sg team of financial planners will compare and provide you with the best insurance savings plans based on your inputs.

Contact:

Email:

Wish to have your insurance savings plan customised for your savings need?

Drop us a message and let InterestGuru.sg contact you instead. We will assign licensed financial advisers to work on your inquiry at no cost to you.

Note: All financial figures, unless otherwise stated are based on close approximate and all non-guaranteed figures are based on the higher tier of 4.75% investment returns. The sample illustrations are for illustrative purposes only and is not a contract of insurance. Illustrated figures are based on close estimates during the generating of benefit illustrations. Early surrendering or cashing out from a life insurance policy will certainly result in financial losses. In the event of doubt, always refer to the precise terms and conditions as specified in your policy contract. Seek the advice of a qualified financial professional or a licensed financial adviser before making any decision or financial commitment.

*Terms and conditions may apply, speak to our financial planners or drop us a message for more details.