AXA Retire Treasure II Review

The complete Pros and Cons on AXA Retire Treasure II

AXA Retire Treasure II provides you with annual income while leaving a legacy for your next generations for them to reap the full benefits of the policy.

AXA Retire Treasure II product details

- Life policy – Annuity

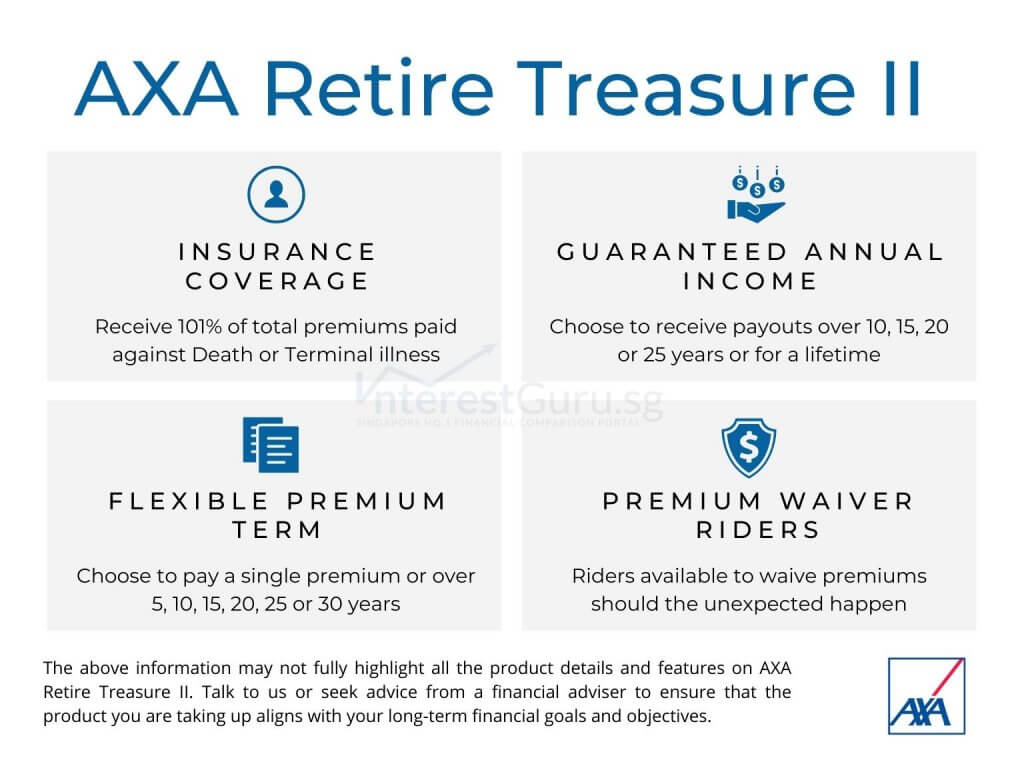

- Guaranteed Annual Income

- Receive annual income to fund your retirement or choose to re-invest at a 3% per annum return rate

- Secondary Life Assured

- You can choose to appoint a Secondary Life Assured, in the event of death or terminal illness of the Primary Life Assured, your family will still be protected

- Potential Total Yield

- Enjoy a potential yield of up to 4.24% per annum upon maturity

- 100% Capital Guaranteed

- You will receive 100% of the total premiums paid at the end of the premium payment term

- Flexible Policy Terms

- Choose your Premium Payment term of 1, 5, 10, 15, 20, 25 or 30 years

- If you choose 1, 5, or 10 years Premium Payment term, there will be a 5-year Accumulation Period

- Choose your Payout Period of 10, 15, 20, 25 years or Lifetime (Age 120)

- Choose your Premium Payment term of 1, 5, 10, 15, 20, 25 or 30 years

- Guaranteed Acceptance

- Enjoy hassle-free application with no health checks or questions asked

- Insurance Coverage

-

- Receive 101% of total premiums paid and accumulated bonuses in the event of Death or diagnosis of Terminal Illness

-

Read about: Why your retirement planning starts now

Read about: 3 best Retirement plans and Annuity policies in Singapore (2023 Edition) *Updated*

Read about: The Complete Guide to Retirement Planning (2023 Edition) *NEW*

Features of AXA Retire Treasure II at a glance

Cash and Cash Withdrawal Benefits

Cash value: Yes

Cash withdrawal benefits: Yes

Health and Insurance Coverage

Death: Yes

Total Permanent Disability: No

Terminal Illness: Yes

Critical Illness: No

Early Critical Illness: No

Health and Insurance Coverage Multiplier

Death: No

Total Permanent Disability: No

Terminal Illness: No

Critical Illness: No

Early Critical Illness: No

Optional Add-on Riders

- PremiumEraser Total

- Premium Waiver (UN)

- Premium Wavier (CIUN)

Additional Features and Benefits

Yes.

For further information and details, refer to AXA website. Alternatively, fill-up the form below and let us advise accordingly.

Read about: How can I accumulate a million dollar (Realistically)

Read about: Effects of compounding returns on your investments

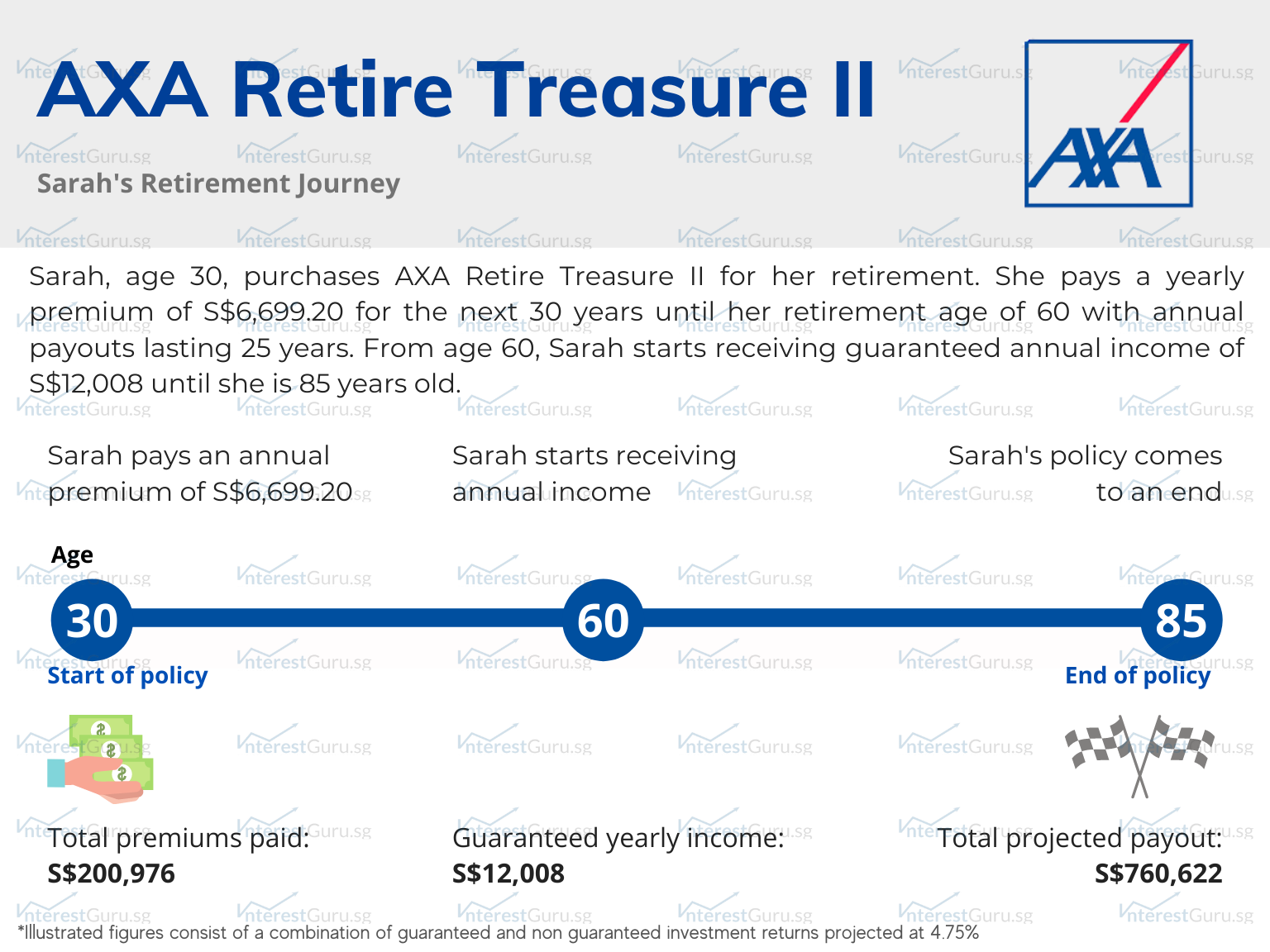

Policy Illustration for AXA Retire Treasure II, Sarah

Sarah, age 30, purchase AXA Retire Treasure II for her retirement. She chooses to pay a yearly premium of S$6,699.20 for the next 30 years. She chooses a 25-year payout period.

Upon reaching 60 years old, Sarah finishes her premium payment with S$200,976 paid in premiums. She begins receiving guaranteed yearly payouts of S$12,008 for the next 25 years.

At age 85, Sarah’s AXA Retire Treasure II policy reaches its maturity, Sarah will receive a total projected payout of S$760,622.

Of the total projected payout, S$300,200 is the guaranteed payouts and S$460,422 is the non-guaranteed bonuses.

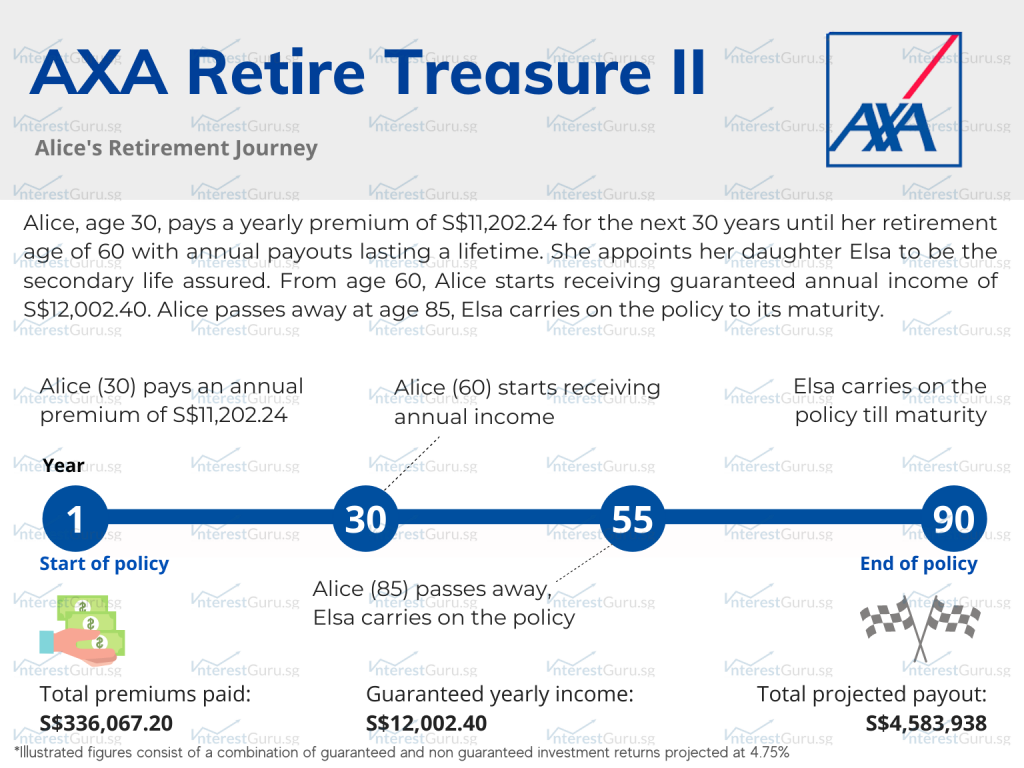

Policy Illustration for AXA Retire Treasure II, Alice

Alice, age 30, purchase AXA Retire Treasure II for her retirement. She chooses to pay a yearly premium of S$11,202.24 for the next 30 years. She chooses a lifetime of annual payouts and appoints her daughter Elsa as the secondary life assured.

Upon reaching 60 years old, Alice finishes her premium payment with S$336,067.20 paid in premiums. She begins receiving S$12,002.40 per year for the rest of her life.

Alice passes away shortly after her 85th birthday. Elsa carries on AXA Retire Treasure II to its maturity while enjoying the guaranteed yearly income.

Upon reaching the 90th policy year, AXA Retire Treasure II matures with a total projected payout of S$4,583,938.

Of the total projected payout, S$720,144 is the guaranteed yearly payouts, and S$3,863,794 is the non-guaranteed bonus.

AXA Retire Treasure II may be suitable if you are looking for

AXA Retire Treasure II may potentially be a good fit if the following matters to you:

- Lifetime regular cash payout

- Saving regularly over a period of time or

- A one-time premium commitment with no further cash commitment

- Insurance options without medical underwriting

- Do not need access to the funds until retirement

- To potentially generate higher financial returns compared to bank accounts

AXA Retire Treasure II may not be suitable if you are looking for

AXA Retire Treasure II may potentially be a bad fit if the following matters to you:

- Health and Protection coverage

- High insurance coverage for Death or Terminal Illness

- Insurance coverage for Early Critical Illness, Critical Illness or Total Permanent Disability

- Lump-sum payout upon maturity

- Potentially higher financial returns compared to a pure investment product.

- Insurance policy with a high surrender value in the early years of the policy.

Further considerations on AXA Retire Treasure II

- How is AXA or AXA Retire Treasure II investment returns based on historical performance?

- How does AXA Retire Treasure II compare with Endowment policy from other insurance companies?

- Can AXA Retire Treasure II fulfill my financial, insurance, health, and protection needs?

The above information may not fully highlight all the product details and features on AXA Retire Treasure II. Talk to us or seek advice from a financial adviser before making any decision about AXA Retire Treasure II.

Always ensure your long-term financial goals and objectives are aligned with the financial product you are considering to take up.

Where can I compare the payout and benefits of retirement plans and annuity policies?

Your retirement plans are meant to supplement your lifestyle and expenses in your golden years. Ensure your retirement plans matches the financial goal and objective you wish to achieve when you decided to talk a step back in life.

It is too late to regret once you have made your financial commitment. Specific product features, benefits, and payouts will differ more than you think across insurance companies.

And even worse, to know you can compare retirement plans and annuity policies here, 100% free of charges on the InterestGuru.sg platform.

Is AXA Retire Treasure II suitable for me?

Contact InterestGuru using the form below. Our panel of licensed financial advisers will advise accordingly, based on your financial profile and protection needs.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Get your perfect retirement plan!

3 easy steps for your customised retirement income plan based on your financial needs.

Step 1: Getting to know you…

Let's start with your personal profile. Please note that your current age and gender will affect the insurance premium payable for your retirement plan.

Name:

Gender:

Birthdate:

Step 2: Understanding your retirement needs…

Please select your desired retirement income and the payout age for your retirement plan from the selections below:

What is your ideal monthly retirement income?

What is your ideal retirement age?

Step 3: Finding the best retirement plans for you!

Interestguru.sg team of financial planners will compare and provide you with the best retirement plans based on your inputs.

Contact:

Email:

Please check your inbox for an e-mail of your savings needs.

We will be in contact with you within 24 hours.