NOTE: Aviva MyLongTermCare has been discontinued. For further information and details about this plan, fill up the form below and let us advise you accordingly.

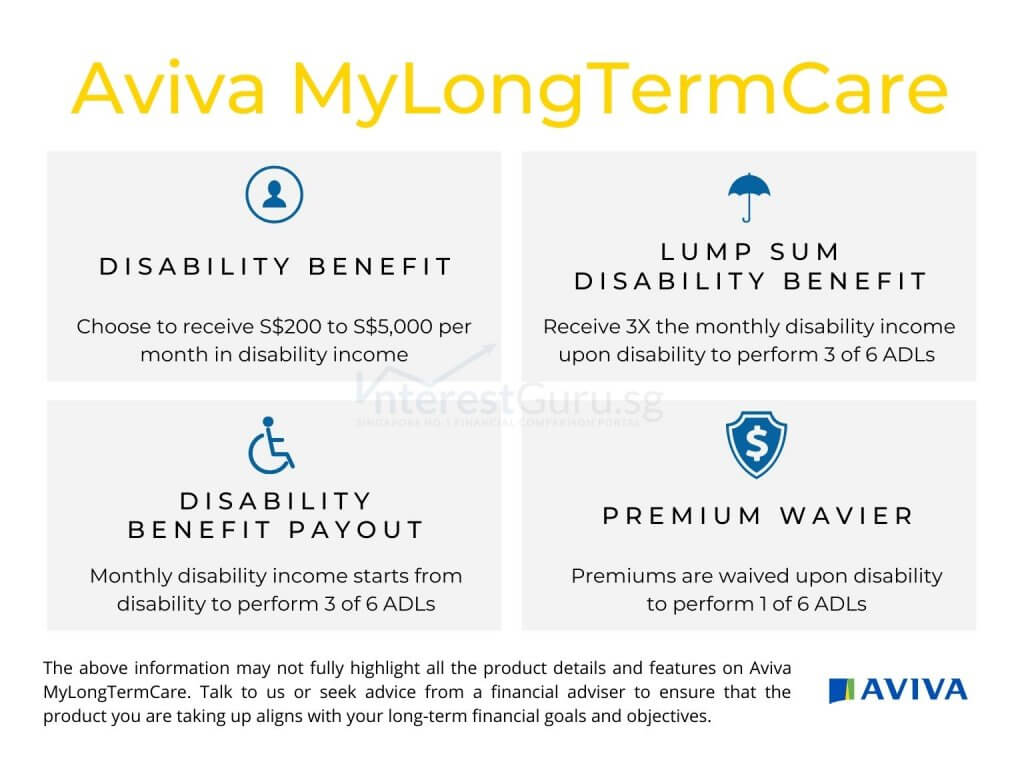

Aviva MyLongTermCare is a CareShield Life supplementary plan that provides a lifetime of monthly disability benefits upon making a successful claim.

Aviva MyLongTermCare starts payout upon disability to carry out 3 of 6 Activities of Daily Living (ADLs).

Aviva MyLongTermCare product details

- Non-participating policy – Disability Income Insurance

- Coverage

- Receive monthly payouts from S$200 to S$5,000 upon disability to carry out 3 of 6 ADLs

- Lump Sum Benefit

- Receive a lump-sum amount of 3x the monthly disability benefit upon disability to carry out 3 of 6 ADLs

- Dependant Care Benefit

- Receive an additional 20% of your monthly disability benefit for up to 36 months if you have a child under 22 years old when making a claim

- Rehabilitation Benefit

- Receive 50% of the last monthly benefit when your condition improves but still unable to carry out 2 of 6 ADLs

- Caregiver Relief Benefit

- Receive an additional 60% of your monthly disability benefit for up to 12 months along with the monthly disability benefit

- Death Benefit

- Receive 3x the monthly disability benefit if death were to happen while receiving the monthly disability benefit

- Premium Waivers

- Future premiums are waived upon disability to carry out 1 of 6 Activities of Daily Living

- MediSave Fundable

- Premiums can be paid with your MediSave up to $600 per month

The better coverage version is Aviva MyLongTermCare Plus

Read also: An Introduction To Disability Income Insurance Policies

Features of Aviva MyLongTermCare at a glance

Cash and Cash Withdrawal Benefits

Cash value: No

Cash withdrawal benefits: No

Health and Insurance Coverage

Death: No (Yes if death occur whilst receiving disability benefit)

Total Permanent Disability: No

Terminal Illness: No

Critical Illness: No

Early Critical Illness: No

Health and Insurance Coverage Multiplier

Death: No

Total Permanent Disability: No

Terminal Illness: No

Critical Illness: No

Early Critical Illness: No

Optional Add-on Riders

NA

Additional Features and Benefits

Yes.

Read Also: No budget for financial planning?

Read also: Guide on Retirement Planning in Singapore

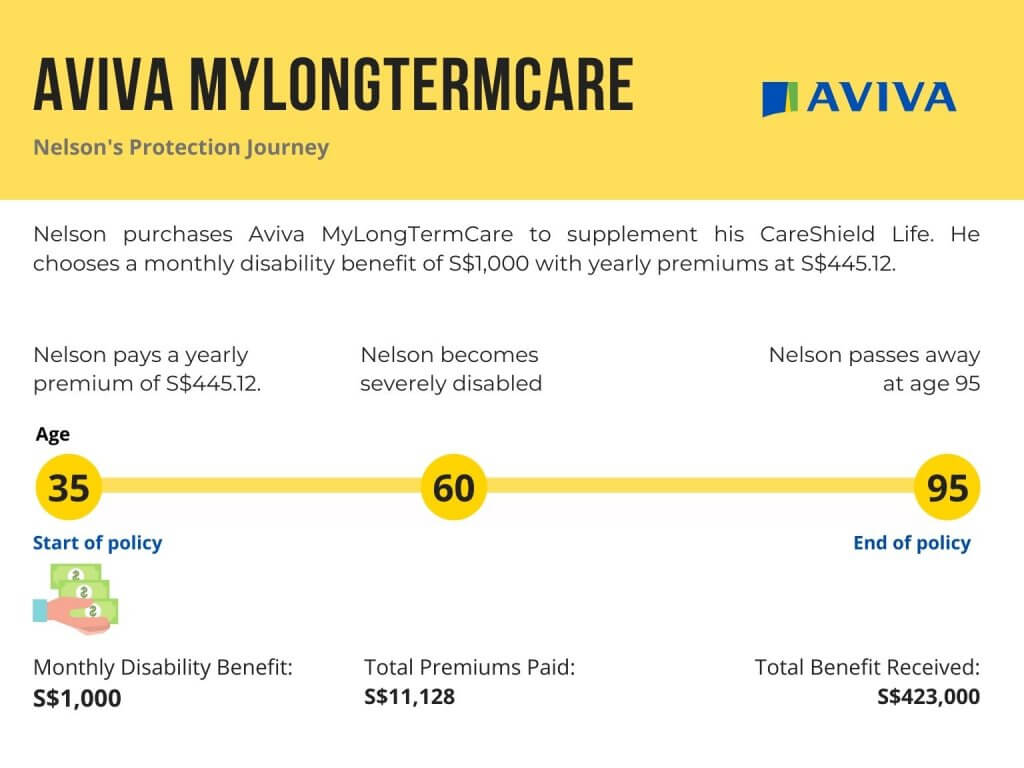

Policy Illustration for Aviva MyLongTermCare, Nelson

Nelson, age 35. purchases Aviva MyLongTermCare Plus to supplement his CareShield Life Plan to boost his disability care in the event he becomes disabled.

Nelson chooses an additional monthly benefit of S$1,000 with an annual premium of S$445.12. Both premiums and disability benefits are fixed.

At age 60, Nelson becomes severely disabled and is no longer able to perform 3 of 6 Activities of Daily Living. He begins receiving a lifetime of monthly disability benefit and all future premiums are waived.

With a total of S$11,128 paid in premiums, Nelson receives S$423,000 in disability benefit before passing away at age 95.

Is Aviva MyLongTermCare suitable for me?

Contact InterestGuru using the form below. Our panel of licensed financial advisers will advise accordingly, based on your financial profile and protection needs.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

*For a limited time, get attractive incentives when you take up any products that is proposed by our team of financial planners.

We compare quotations head to head on all leading insurers in Singapore

Contact Form