3 things to consider before taking up a new financial plan

Consider all available options and alternatives when it comes to your financial portfolio.

Taking up a new financial product would usually require a long-term financial commitment. The expected time horizon before you can fully maximise your gains may even be longer than the stated projected. At the end of the day, your financial and investment returns may not always be guaranteed.

You should at least understand and take into consideration the following before taking up a recommended financial product.

- The financial product purposes and suitability to you

- How much are other companies are offering or charging

- Fees and charges required of the financial product (Including Recurring)

1. Know the purpose of taking up the new financial plan

Just a simple objective of wealth accumulation would result in an endless range of options depending on your preferences. Your expected time horizon, financial budget, risk appetite, and financial objectives are unique based on your personal life goals.

With that said, you must understand where does the new financial plan fit towards your overall financial portfolio in the long run.

1.1 If you need health and protection coverage

Term and Whole Life insurance policy will likely be suitable products as they offer a high of insurance coverage compared to other categories of insurance product.

Ensure that you have sufficient coverage for Early Critical Illness, Critical Illness, Total Permanent Disability, and Death in your insurance portfolio.

Related categories: Term Insurance, Whole Life Insurance

Related article: How much insurance coverage do you need? (An in-depth financial planning analysis)

The advantages of term policies for insurance coverage

Term insurance is an excellent choice for a temporary boost to your health coverage due to the lower premium payable. However, the total cost of long-term continual coverage may be much higher compared to a limited payment whole life insurance policy.

This is especially true if there are no claims paid out and your coverage is extended to your late 70s and onwards.

- Lower initial yearly premium

- Premium is payable yearly until the policy matures

- No cash value accumulated over time

- Coverage is usually for a fixed period of years

- Premium will increase upon plan maturity due to your increased age

Term insurance is a suitable option if

Term Insurance may fit your financial needs if you below to one of the profiles below:

- Budget-constrained adults that recently started working

- Require additional financial assurance (New-born child, Mortgage, etc)

- Sole or main breadwinner in the family

- Savvy investor generating wealth via other financial products

Related article: Term and Whole Life Comparison- Which is Suitable For You?

The advantages of whole life policies for insurance coverage

Whole life insurance plans combine the benefits of protection with long-term wealth accumulation. Whole life plans are commonly marketed to last you throughout your life, with increased insurance coverage multiplier until your retirement.

Usually, the insurance coverage multiplier ends in your early 70s in order for the premium payable to be competitive.

- Higher initial yearly premium

- Premium is payable for a limited period of years

- Cash value increase over time (Both guaranteed and projected)

- Coverage last for a lifetime (Or until a full claim or surrender of cash value)

- Financial commitment ends upon selected premium period

Whole life insurance is a suitable option if

Whole life insurance may fit your financial needs if you require one or more of the following features:

- High and multiplied insurance coverage

- Limited period of financial commitment

- Lifetime insurance coverage

- Long-term stable wealth accumulation

- Lump sum cash withdrawal in your later life stages

- Not seeking investment risk and volatility

Use the whole life comparison portal to get in-depth details on your whole life insurance plans! *NEW*

Related article: 3 Best Whole Life Insurance Plan in Singapore for Insurance Coverage (2023 Edition)

1.2 If you need stable and guaranteed wealth accumulation

By now, your financial adviser or insurance agent would have recommended you to start doing regular savings in an endowment plan or a retirement annuity policy. In return for potentially higher financial returns, your savings will be lock-in until the maturity or payout of the said financial product.

The advantages of Endowment and Saving Plans for stable wealth accumulation

Most of the endowment plans and savings policies currently offered in Singapore are minimally principal guaranteed when held to maturity. Do carefully consider all of your available options and offerings from other insurance companies in the event that the above is not met.

This ensures that any yearly bonus generated from investment returns is added on top of your principle, instead of filling up the shortfall to guarantee your principal sum.

Related categories: Savings and Endowment, Retirement Annuity Policies

Endowment and Saving Plans is a suitable option if

Endowment and Saving Plans may fit your financial needs if you require one or more of the following features:

- Regular discipline savings over a period of years

- Flexibility for withdrawal

- Higher interest rate than traditional banking accounts

- Looking to fulfil a short to mid-term financial goals that require a lump sum of money

Related Article: 3 Best Saving Endowment Plan in Singapore with Fixed Maturity (2023 Edition)

Related Article: 3 Best Savings Endowment Plan in Singapore with Lifetime Wealth Accumulation (2023 Edition)

The advantages of Retirement Annuity Plans for stable wealth accumulation

As compared to an endowment saving plan, a retirement annuity plan is meant for long-term wealth accumulation until your desired retirement age. Taking advantage of compounding returns, the total achievable payout can be multiples of your initial principal sum.

Related article: 5 Reasons to invest in a Retirement Annuity Plan

Related article: The Complete Singapore Guide to Retirement Planning (2023 Edition) *NEW*

Retirement Annuity Plans is a suitable option if

Retirement Annuity Plans may fit your financial needs if you agree with most or all the following:

- Long-term compounding of principal investment for a high and guaranteed financial returns

- Unlikely to have ANY withdrawal of the funds set aside until payout starts from the policy

- Looking for a consistent stream of income

- Seeking options for an inflated or lifelong income payout

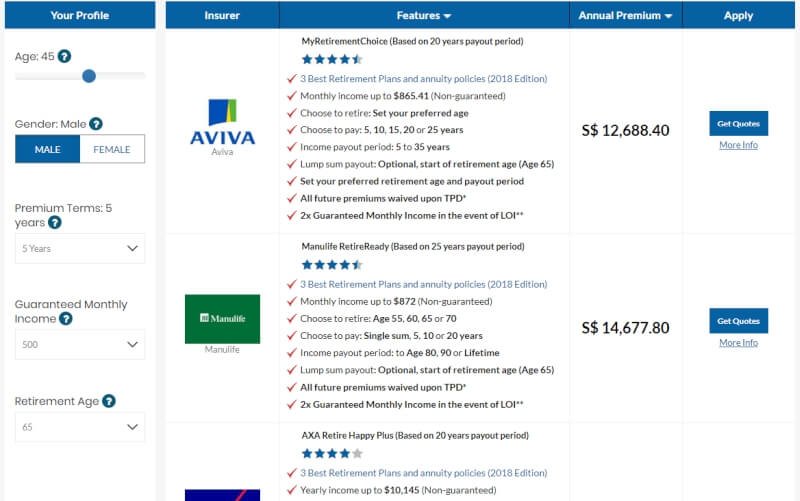

Use the retirement annuity comparison portal to get in-depth details on your retirement annuity plans! *NEW*

1.3 If you are seeking high wealth accumulation

Seeking higher financial returns comes with higher risk. Commonly offered products are Unit Trust Funds and Investment Linked Insurance policies. Most investment products are subjected to market volatility and not capital guaranteed. In the event of a financial downturn, one must be prepared to ride out the price fluctuation.

Related categories: Unit Trust Fund, Investment Linked Insurance Policy

Related article: 4 mistakes that will result in the loss of all your investment funds

The advantages of Unit Trust Funds for high wealth accumulation

As an investor in a unit trust fund, you can own a basket of assets of your preferred investment. This can be achieved at a fraction of the cost compared to individually owning all the securities held by the trust fund.

Depending on your risk profile and preferences, your investment portfolio may consist of a combination of:

- Equities Funds (Pure Stocks)

- Balanced Funds (Equities and Bond)

- Bonds Funds (Pure Bonds)

- Money Market Funds (Short-term government and investment graded securities)

Unit Trust Funds is a suitable option if

Unit Trust Funds may fit your financial needs if you are aware of and agreed with all the following:

- No cap or limits on your investment returns

- Your principal investment is not guaranteed

- Aware that there is a possibility to lose most or all of your investment capital

- Seek a wide diversify towards long-term investment

Related Article: Reasons to invest in Unit Trust Funds

Related Article: ETFs or Unit Trust Funds – Which is more suitable for you?

The advantages of Investment Linked Policies for high wealth accumulation

An Investment Linked Policy (ILP) have both life insurance and investment components. Your premiums are used to purchase units in an Investment Linked sub-fund(s) of your choice. On a regular basis, a portion of the units you purchased are then sold to pay for insurance related charges, while the rest remain invested.

For the same amount of premium compared to all other life insurance products, an Investment Linked Policy allows you to get the highest coverage on an apple to apple comparison.

Investment Linked Policies are a suitable option if

Investment Linked Policies may fit your financial needs if you are aware of and agreed with all the following:

- Your premiums/ principal investment is not guaranteed

- Aware that there is a possibility to lose most or all of your investment capital

- Mortality and insurance charges will greatly increase as you ages

- Potential financial returns may be higher or lower compared to other long-term savings and investment plans

Related article: Investment Linked Policies – Is it suitable for you?

Related article: 3 best Investment Linked Policies in Singapore (2023 Edition)

2. Know the factors that can affect your financial returns

Depending on the type of insurance or investment products that is relevant to you, your financial gains and coverage may vary accordingly. Most of the time, some slight changes can be made by your financial advisers to better maximise your financial gains.

Note: Not all financial products can be optimised to provide a higher rate of return.

Quick facts about insurance plans

- The annual premiums can vary by up to 15% across insurers for the same amount of coverage

- The difference in financial returns upon maturity can be up to 35% for the same amount of premium paid

Quick facts about investment products

- The annualised returns between 2 unit trust funds with similar investment objectives can vary by up to 5%

- Your yearly investment charges and platform fees can greatly impact your absolute investment returns

Feel free to Drop us a message and a licensed financial adviser will try to find competitive options on your current financial selections.

2.1 Understand the financial rate of return

Understand the effective rate of return of the financial product taken. A small difference in the percentage of return can lead to a huge difference due to the effect of compounding.

Ensure that you are comfortable with the Guaranteed and non-guaranteed returns, as your benefit illustration will provide a projection of the possible best and worst case scenario.

Related article: Understanding your Insurance policy (Part 1 of 2)

Related article: Understanding your Insurance policy (Part 2 of 2)

Avoid putting off financial planning due to insufficient budget wherever possible. Most of the time, it is about how early you start, instead of how much more you can save instead in your later years.

2.2 Know about payment options

Monthly, quarterly, semi-annually and annually premium options are usually available for Insurance policies. It is usually cheaper to make payment on an annual mode as the additional premium paid for other payment modes does not go into the policy.

Investment Linked Policies are an exception, as you should take advantage of dollar cost averaging by paying/ investing your premiums on a monthly basis.

Related article: Should I pay my insurance premium monthly or yearly?

2.3 Know about premium options

If your financial budget allows, aim for a premium term with a short number of years. At the same time, allowing the longest period possible to the withdrawal or maturity of your financial plan.

By compressing and completing payment over a shorter period of time, your funds have a longer period of time to compound for higher investment returns,

Related article: Why you should aim for a short insurance premium term

3. Recurring Fees and Charges

Be it insurance or investment products, there will be fees and charges involved towards marketing the product to the consumer (You). Certainly, your adviser has to make a living and the insurance firm has to make a business from offering health and wealth policies to you.

Related article: 8 Commonly made financial mistake by Singaporeans

3.1 Are you aware of the following insurance charges?

Some insurance policies such as Investment Linked Policy (ILP) has a mortality charge that is not indicated in the Benefit Illustration of the policy. The mortality charge increases substantially as one aged, hence coverage for ILPs should be replaced by other insurance policies as you ages.

There may also be fees imposed during the buying (Front End Loading) or selling (Back End Loading) for certain insurance products. Distribution cost will also be involved in every insurance policy and it will be clearly stated in your Benefit Illustrations.

3.2 Are you aware of the following investment charges?

Investment products may have a sales charge ranging from 0.1% – 5% of the initial invested amount. There may be a yearly wrap account fee that allows you to do unlimited switch and management of your investment portfolio.

The majority of the above sales and wrap fees go towards the adviser, consider reaching an agreement that both of you are comfortable with.

Lastly, the platform and investment fund company that holds and manages your investment will charge a fee for using their services. A platform fee and managment fee is charged for maintaining and investing your money respectively.

Related article: How can I accumulate a million dollar (Realistically)

Related article: 5 ways you can overcome rising inflation

Always consider carefully before you commit

Do not be in a hurry to commit to a new financial product. Always double check and ensure that the details provided by your financial advisers or insurance agents are accurate and stated on the given benefits illustrations.

In the event of doubt, get opinions from a third party financial professional to ensure that you get the most competitive products based on your financial needs and goals.

Where can I compare financial returns and benefits of insurance plans?

It is too late to regret once you have made your financial commitment. Specific products features, benefits and payout will differ more than you think across insurance companies.

And even worse, to know you can compare all insurance plans and policies here, 100% free of charges on the InterestGuru.sg platform.

Not sure exactly what is the most suitable financial product? Simply looking for a second opinion to ensure you get only the best?

Drop us a message and let us try to provide you with the available options.

Don’t worry, our licensed financial advisers don’t charge for consultation and there is no obligation to take up their recommendation!