We typically don’t think about needing life insurance until we’re older and need to start thinking about ways we can pass down funds to our loved ones after our death. However, life insurance is an important form of protection that is more than just providing a legacy after you die. It will also provide much needed peace of mind in a variety of different circumstances if something should happen to you and your dependants are left with no other financial recourse. Below, we list 3 surprising reasons why you may actually need a life insurance policy now.

1. You Take Care of a Disabled Family Member

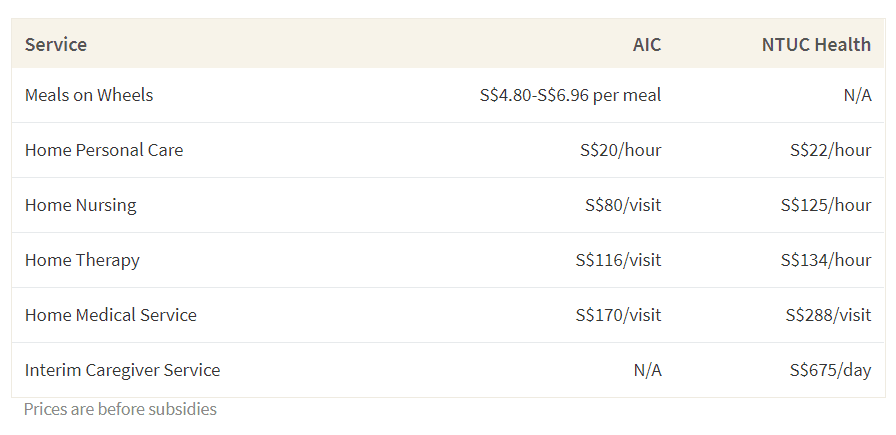

If you are taking care of someone with a disability, you know then how much it costs to ensure their comfort and healthcare needs. While Singapore offers disability coverage for its citizens, living with a disability is very expensive. In fact, annual costs can be as high as S$12,500 per year. Furthermore, if you were their primary caretaker, then you’ll also need to consider who will take care of your loved one if something happens to you. This means you’ll need to pay for caregivers and nurses for at least a good portion of their life.

That said, even if you don’t currently take care of a family member, it’s good to leave enough funds so that they’ll be able to take care of themselves in the event of an accident. To help supplement disability payouts the Singaporean government provides, a life insurance policy can help your loved ones live comfortably with their disability should you pass away or become totally and permanently disabled.

2. You Have High Monthly Loans and Expenses

Another reason why life insurance is necessary is because it helps your dependants pay off any large expenses, like a mortgage. With mortgages costing between S$1,800 and S$2,000 per month for a home loan of S$500,000, they’ll make up a considerable amount of your bills. A life insurance policy that has a high enough sum assured to cover the remaining home loan can be very beneficial in ensuring that your loved ones have a roof over their head should something happen to you.

While you can get a mortgage insurance policy—which should cover the remaining home loan should you die—a life insurance policy may be a better fit if you are looking for a convenient policy that will pay out one sum for everything your dependants need, including any outstanding loans. Furthermore, a life insurance policy can also quickly cover unexpected emergencies since insurers are quick to adapt to changing situations. Take for instance, Tiq by Etiqa Insurance, who is providing up to S$52,000 of complimentary financial assistance benefits for life insurance customers who got hospitalised or passed away due to COVID-19 and up to S$2,000 of coverage if a customer suffered COVID-19 vaccination-related side effects.

Other final expenses you’ll need to consider are outstanding car loans, credit card bills and hospital bills. These will all need to be paid by your surviving family members. Unfortunately, if you were the main breadwinner, paying for these smaller bills may still not be realistic for your loved ones. For instance, paying for your S$60,000 car loan will add another S$1,200 to your loved one’s monthly responsibilities for the next few years and even a moderately sized credit card bill of S$5,000 can quickly accumulate interest payments if not paid off in full. Thus, if you have a high debt burden that you’re primarily responsible for paying back, even a simple term life insurance policy can act as a valuable contingency plan to prevent your family from going into unmanageable debt.

3. You Want to Ensure Your Child Can Afford College

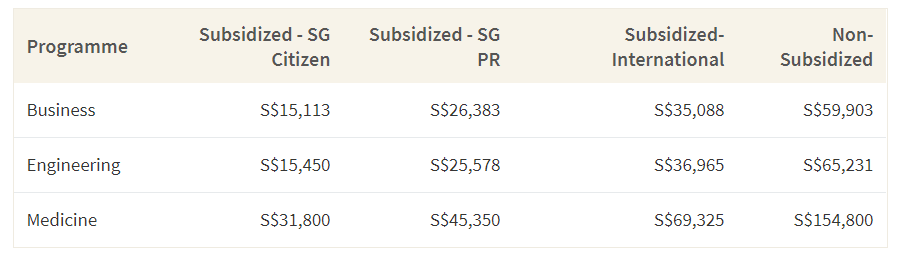

If you have little ones, it is recommended that you get life insurance so they can go to college. Why? Besides providing a lump sum that will help your child survive until they can earn money on their own, your lump sum payout can go towards their education, which currently costs up to S$28,900 per year—even after subsidies.

Average Tuition Cost by Programme for AY 2023

Furthermore, suppose you have enough savings to pay for a local university but your child decides later on they want to go abroad. International universities can be incredibly costly. A 4-year degree from a US university will cost over S$130,000. If you were to die prematurely before accumulating enough savings to fund your child’s education, your life insurance payout could be a good way to cover the remaining costs. Thus, planning ahead and choosing a life insurance policy that is able to anticipate the costs of your child’s education can be useful in making sure your child starts their adult life on the right foot.

How Much Life Insurance Coverage Do You Need?

Ultimately, there is no one-size-fits-all approach to life insurance. To see what kind of life insurance policy you need, you’ll need to determine whether you want a whole life policy or a term life policy. Whole life insurance covers you for your entire life and may also provide a cash bonus and other benefits like multipliers and top-ups at life events. However, term life policies are cheaper than whole life policies, and will only cover you for a certain number of years (5 years, 10 years, 20 years, up to age 65, etc.), making them flexible and affordable protection plans. Regardless of the type you choose, you’ll need to make sure you can afford your premiums throughout the course of the plan. Otherwise, your coverage will lapse and you won’t be able to get back all the premiums you’ve been paying in for all those years.

So what about coverage? The amount of coverage you need depends on your liabilities, assets and how you want your funds to be distributed. Your chosen coverage should definitely cover all your debts that can’t be paid off with your assets (like savings plans, investments, etc.) so they don’t get passed down to your dependents. You will also need to consider any other financial obligations your dependents may experience, such as the ones mentioned earlier and general living expenses and funeral arrangements. Lastly, you’ll need to see what life events concern you the most. For instance, as we’ve seen in 2023, an unexpected pandemic can occur and unexpectedly turn your family’s life upside down.

Whether it’s a road accident or a global pandemic, unexpected events are unavoidable. A good life insurance policy will be affordable for the coverage you need and provide benefits when faced with the unexpected. For coverage against death and total and permanent disability, even a simple term life policy need not be underestimated.

This article and accompanying images (if any), were reposted from ValueChampion. The views and opinions expressed are those of the author and do not necessarily reflect InterestGuru.sg.