3 Best Retirement Plans with Guaranteed Principal Withdrawal (2020 Edition)

Look no further if you are seeking a stream of retirement income while having the option to withdraw the premium paid for your annuity plans!

Investing in a retirement annuity plan would usually mean that your principal/ capital is locked up for a long period of time. What if there are retirement plans with guaranteed principal withdrawal features to retain the option of lump sum withdrawal of your principal?

Your retirement plans can provide more than a guaranteed income stream.

By now, you would have heard of retirement plans with a guaranteed income stream, or a guaranteed payout higher than the total premium you have paid for the plan. However, such retirement plans offered means that your money is locked up over a long period of time.

Reviewing retirement plans and annuity policies across all insurers in Singapore, we compiled a comprehensive list of the 3 best retirement plan with guaranteed withdrawal of principal:

- Best for shortest waiting period to start of income payout – Aviva MyLifeIncome

- Best for highest projected surrender value – Manulife Signature Income

- Best for legacy/ third generation income planning – NTUC Income VivoWealth Solitaire

The main objective is such a retirement plan is to provide a stream of guaranteed income when you leave your principal sum untouched, yet the option of collecting back all the principal paid when you like to.

Read about: How can you accumulate a million dollar in your savings

Read about: 5 reasons to invest in a retirement annuity plan *NEW*

What do we mean when we say retirement plans with guaranteed principal withdrawal?

There is nothing unique or special about a guaranteed income payout, especially when that is the sole purpose of a retirement plan. What we are looking for in a retirement plan with guaranteed principal withdrawal must have the following features:

- Guaranteed withdrawal of all or minimally 80% of the insurance premium you have paid for the annuity

- The value of the guaranteed withdrawal excludes the monthly income stream collected

- A stream of income, with a part of the income being guaranteed

- Capital appreciation of principal sum, should you choose to continue receiving income and delay withdrawal of premium paid (Bonus feature)

There is no doubt that your monthly retirement income can be even higher if you are fully committed to a retirement plan that lock in your premium for a higher income or an inflation-proof payout. However, the tradeoff is that you will not be able to withdraw your principal sum at your whims.

Don’t let the misconception that your principal will be locked up in an annuity policy stop you from generating a stable stream of income for your retirement.

Read about: Why should you use your SRS to get a retirement plan

3 Best Retirement Plans with Guaranteed Principal Withdrawal

In no order of preference, we listed some of the best retirement plans that allow you to have a high rate of financial yield, yet freeing up most of the financial lock commitment typical of a retirement plan.

Note that the stated yields are very close approximates. Your actual yields and financial returns will depend on your current age and the years you let your premium compound.

Read about: Why your insurance premium term should be as short as possible

Read about: The effects of compounding returns on your money

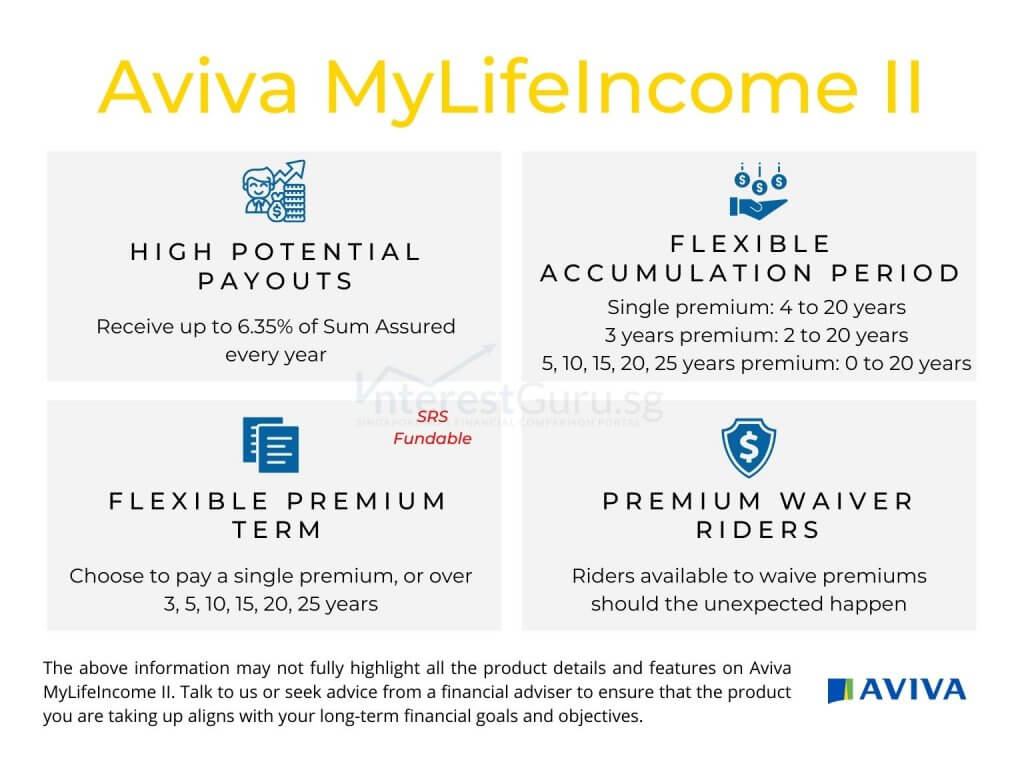

1.) Best for shortest waiting period to start of income payout – Aviva MyLifeIncome

Aviva MyLifeIncome is the latest retirement annuity policy in Singapore that is 100% Capital Guaranteed upon reaching the end of your selected accumulation period.

This means that you can surrender your policy at any point in time during your income payout period to get the total premium you have paid for the retirement plan.

- Accumulation period options (Based on premium payment term):

- Single premium payment: 4 to 40 years

- 3 years premium payment: 2 to 40 years

- 5, 10, 15, 20, 25 years premium payment: 0 to 40 years

MyLifeIncome goes a step further to further guarantee that your Surrender value will increase by 0.25% p.a (compounded), starting from the 5th policy year after the end of your desired accumulation period.

Based on the profile of a 50 year old male that wishes to start receiving his payout at age 56:

- Total premium paid: $249,498

- Guaranteed surrender value at age 60: 100%

- Guaranteed yearly income: 1.75% p.a

- Projected yearly income: 4.95% p.a

- Projected surrender value at age 80: $270,380

The advantages of Aviva MyLifeIncome

As per the illustrated chart below, MyLifeIncome offers the highest guaranteed and projected income payout compare to its other peers, at the cost of a lower projected surrender value in the future.

What makes MyLifeIncome by Aviva outstanding is that 100% of the total premium paid is guaranteed in as short as 4 years from placing a single lump sum. Should you choose to spread your premiums over a 5 years period, your capital can be guaranteed immediately at the end of the 5th year of premium payment.

The disadvantages of Aviva MyLifeIncome

The projected surrender value of the policy does not increase as higher over time compared to Manulife Signature Income. However, the guaranteed surrender value will consistently increase over time by 0.25% compounded on a yearly basis.

Refer to: Aviva MyLifeIncome review

2.) Best for highest projected surrender value – Manulife Signature Income

Manulife Signature Income is one of the most competitive annuity plans in the Singapore market, in terms of capital appreciation and income payout. It is also part of the newly launched signature series of products catered towards HNW individuals.

The policy is made attractive with a payout that starts from the 5th policy year, assuring you of a lifelong income stream while accumulating your surrender value over time.

Based on the profile of a 50 year old male that wishes to start receiving his payout at age 55:

- Total premium paid: $249,900

- Guaranteed surrender value at age 60: 80%

- Guaranteed yearly income: 1.59% p.a

- Projected yearly income: 3.53% p.a

- Projected surrender value at age 80: $339,671

The advantages of Manulife Signature Income

Manulife Signature Income can be transferred to your future generation for legacy planning. This means that you can receive an income stream as you live, while your spouse and children can take over after your demise. They can continue to receive a payout while letting the plan accumulate for an even higher lump sum surrender value.

Among the all the retirement annuity plans, Manulife Signature Income has the highest rate of growth on the projected surrender value. While projected values are non-guaranteed, the plan may potentially enhance capital gains if the yearly declared investment returns matches the stated illustration.

Signature Income is also available for purchase in USD currency, should you believe that USD will appreciate in the long-term.

The disadvantages of Manulife Signature Income

The projected income payout of Manulife Signature Income is not the highest among the 3 best retirement plans with guaranteed principal withdrawal. This is offset by a higher guaranteed income payout and the benefit of increasing projected surrender value.

Refer to: Manulife Signature Income review

Best for legacy/ third generation income planning – NTUC Income VivoWealth Solitaire

NTUC Income VivoWealth Solitaire is a single premium retirement plan that also allows you to leave a legacy for the next generation. With the monthly income payout starting on the 6th policy year after placing your single premium, you can be assured of a lifelong income stream while accumulating your surrender value over time.

Based on the profile of a 50 year old male that wishes to start receiving his payout at age 56:

- Total premium paid: $250,000

- Guaranteed surrender value at age 60: 80%

- Guaranteed yearly income: 1.56% p.a

- Projected yearly income: 2.56% p.a

- Projected surrender value at age 80: $275,250

The advantages of NTUC Income VivoWealth Solitaire

This annuity can be purchased by having your child named as the insured, allowing the policy to continue paying out an income payout even after your demise. Subsequently, your child can surrender the policy or nominate a beneficiary for a lump sum cash value.

NTUC Income VivoWealth Solitaire pays out an additional year worth of guaranteed income on the 21st and 31st policy year as a unique feature. The surrender value of the policy is also projected to increase over time, allowing for capital appreciation.

The disadvantages of NTUC Income VivoWealth Solitaire

NTUC Income VivoWealth Solitaire has the lowest project yearly income comparing out of the 3 best retirement plans with guaranteed principal withdrawal. However, its high guaranteed income payout is almost on par with Manulife Signature Income.

Refer to: NTUC Income VivoWealth Solitaire review

A detailed comparison of retirement plans with guaranteed principal withdrawal

We have compiled a detailed comparison of retirement plans with a high guaranteed withdrawal of principal upon the surrendering of the policy. The financial figures are based on a male at age 50, with the financial capacity to fully pay the annuity premiums over a short period of time.

The financial objective of the retirement plans stated is to receive a lifetime of income starting at age 60. At the same time, the policyholder is able to surrender the annuity for a full or high guaranteed cash value when required.

Note: For users on mobile devices, you may have to swipe/ scroll on the chart to view the complete data.

| High principal withdrawal retirement plans for: Male, Age 50, Retire at Age 60 |

|||

| Plan Details |  Aviva MyLifeIncome (Payout for Lifetime) |  NTUC Income VivoWealth Solitaire (Payout for Lifetime) |  Manulife Signature Income (Payout for Lifetime) |

| Annual Premium (Payable for 5 years/ Lump sum) | $249,498 (Single lump sum) | $250,000 (Single lump sum) | $249,900 (Single lump sum) |

| Yearly Income Payout (Guaranteed/ Projected) | $4,378/ $12,338 (Payout starts at Age 56) | $3,900/ $6,400 (Payout starts at Age 56) (Additional $3,900 payout on the the 21st and 31st policy year respectively) | $3,990/ $8,820 (Payout starts at Age 55) |

| Yearly Income Payout (Guaranteed/ Projected) As a precentage of the premiums paid | 1.75%/ 4.95% | 1.56%/ 2.56% | 1.59/ 3.53% |

| Surrender Value (Age 65) (Guaranteed/ Projected) | $252,641/ $260,749 | $200,000/ $267,000 | $199,920/ $266,061 |

| Surrender Value (Age 80) (Guaranteed/ Projected) | $262,272/ $270,380 | $200,000/ $275,250 | $199,920/ $339,671 |

| Surrender Value (Age 99/100) (Guaranteed/ Projected) | $275,021/ $283,129 | $262,500/ $435,500 | $199,920/ $540,517 |

Additional note:

|

|||

How to get the most out of a retirement plan?

Your retirement plans are meant to supplement your lifestyle and expenses in your golden years. Find a retirement plan that pays out according to your life objectives before looking at the financial figures.

After all, the yields and the financial payout will not make a difference if the retirement plan does not allow you to utilize it according to your desired retirement lifestyle.

Whenever possible, consider the following before taking up a retirement plan:

- Would you prefer a higher guaranteed or a higher overall non-guaranteed payout?

- Do you need the payout to increase at a fixed rate to keep up with inflation?

- In the event of disability or Critical Illness, do you still have to continue paying your premiums?

- What is the overall annualised yield on the retirement plan?

- Are you expecting a lump sum payout once you reach your retirement age?

- How much guaranteed and non-guaranteed are you expecting to receive if you have to do an early surrender of your policy during your retirement years?

- In the event of disability during the payout period, is there any income multiplier to cover additional costs that will be incurred on your lifestyle?

Ensure that your retirement plan can address your retirement needs and concerns as much as possible. Due to the large financial commitment and long time horizon required, never compromise on what is important to you.

Read about: The comprehensive guide to retirement planning in Singapore (2020 Edition) *NEW*

Read about: 3 Best retirement plans in Singapore- Best in income payout and features (2020 Edition)

Where can I compare the payout and benefits of retirement plans and annuity policies?

It is too late to regret once you have made your financial commitment. Specific products features, benefits and payout will differ more than you think across insurance companies.

And even worse, to know you can compare retirement plans and annuity policies here, 100% free of charges on the InterestGuru.sg platform.

What is the best retirement plans and annuity policies for you?

Our partnered financial planners will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are solely based on your individual needs.

*For a limited time, get attractive incentives when you take up any products that is proposed by our team of financial planners.

Compare Retirement Plans and Annuities from all leading insurers in Singapore

Get your perfect retirement plan!

3 easy steps for your customised retirement income plan based on your financial needs.

Step 1: Getting to know you…

Let's start with your personal profile. Please note that your current age and gender will affect the insurance premium payable for your retirement plan.

Name:

Gender:

Birthdate:

Step 2: Understanding your retirement needs…

Please select your desired retirement income and the payout age for your retirement plan from the selections below:

What is your ideal monthly retirement income?

What is your ideal retirement age?

Step 3: Finding the best retirement plans for you!

Interestguru.sg team of financial planners will compare and provide you with the best retirement plans based on your inputs.

Contact:

Email:

Please check your inbox for an e-mail of your savings needs.

We will be in contact with you within 24 hours.

Getting the best retirement plans has never been this easy!

Drop us a message to have a retirement plan structured to your needs or just to understand more. Don’t worry, there is no obligation to take up any stuff and consultation is free!

Note: All financial figures are based on close approximate and all non-guaranteed figures are based on the higher tier of 4.75% investment returns. The sample illustrations are for illustrative purposes only and is not a contract of insurance. Early surrendering or cashing out from a Retirement plans or Annuity policies will certainly result in financial loss. In the event of doubt, always refer to the precise terms and conditions as specified in your policy contract. Seek the advice of a qualified financial professional or a licensed financial adviser before making any decision or financial commitment.

*Terms and conditions may apply, speak to our financial planners or drop us a message for more details.

Latest Change Log for 3 Best Retirement Plans in Singapore (Guaranteed withdrawal of principal)

Version 1.1 – 24/8/2018

TM Retirement GIO is replaced by Aviva MyLifeIncome due to:

- Higher guaranteed income payout for the same premium

- Higher projected income payout for the same premium

- Increasing guaranteed and projected surrender value features

- Shorter time horizon to 100% capital guaranteed/ guaranteed surrender value